Isn’t it amazing how the business world has changed? You’re no longer stuck hiring locally. The explosion of remote work means your marketing agency can tap into incredible talent pools worldwide. Managing international teams can feel like manoeuvring a minefield of different labour laws and compliance rules.

Employer of Record (EOR) services have emerged as a powerful solution for companies wanting to hire internationally without establishing a legal entity in every country. This guide explores how EOR services can help marketing agencies and e-commerce brands build and manage international teams efficiently, with a special focus on the Irish market.

How EOR Works

An EOR is a third-party organisation that takes on the legal and administrative responsibilities of employing workers on behalf of another company. The EOR becomes the official employer for tax, legal, and compliance purposes, while the client company maintains day-to-day direction of the employee’s work.

When you partner with an EOR, they handle:

- Legal compliance with local employment laws

- Payroll processing and tax withholding

- Benefits administration

- HR support and employee onboarding

- Work permits and visa applications

- Employment contracts aligned with local requirements

This arrangement allows businesses to hire talent in countries where they don’t have a legal entity, significantly reducing the time, cost, and complexity of international expansion. For example, imagine you find the perfect marketing guru in Dublin. Instead of setting up a whole new legal entity in Ireland, an EOR lets you hire them quickly and easily!

Why Choose An EOR?

Why are more and more businesses turning to EOR services? The advantages are significant:

- Save Time and Money: Setting up a legal entity in a foreign country is a complex and costly process. It involves legal fees, registration processes, and ongoing administrative overhead. An EOR allows you to bypass this entirely, getting you up and running with international hires much faster and more affordably.

- Compliance Peace of Mind: Labour laws and tax regulations vary dramatically from country to country. Staying on top of these ever-changing rules can be a major headache. EOR providers have in-depth knowledge of local regulations and make sure your international hires are employed in full compliance, minimising the risk of legal issues, employee misclassification penalties, and backdated tax charges. It’s like having a team of legal experts in every country you operate in.

- Reduced Administrative Burden: Managing international payroll, benefits administration, and HR paperwork can be incredibly time-consuming. An EOR handles these tasks, freeing up your internal teams to focus on your core business activities, like growing your revenue and serving your clients.

- Access to Global Talent: By removing the complexities of international employment, EORs make it easier to hire the best talent wherever they may be located. This opens up a much wider pool of skilled professionals who can contribute to your company’s success.

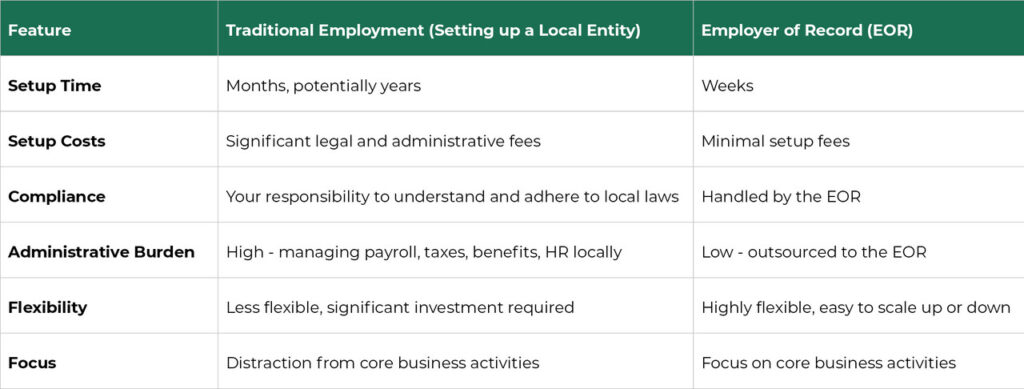

What’s The Difference Between EOR vs. Traditional Employment

The traditional route for hiring internationally often involves establishing a local legal entity or subsidiary. While this might be necessary for very large operations, it comes with significant hurdles. Let’s compare the two approaches:

The EOR model clearly offers advantages in speed, cost, and flexibility—particularly for businesses testing new markets or hiring only a few employees in each location.

Hiring Options

When expanding your team internationally, you have several hiring options to consider. Each option has its own set of benefits and drawbacks, and the best choice depends on your specific business needs and goals.

EOR: Hassle-Free Hiring

Pros:

- Simplified International Expansion: Hire talent in multiple countries without setting up local entities.

- Compliance: EOR ensures compliance with local employment laws and regulations,protecting you from costly misclassification risks and regulatory penalties.

- Reduced Administrative Burden: EOR handles payroll, taxes, benefits, and HR tasks.

- Speed and Efficiency: Quickly onboard international employees and start operations.

Cons:

- Cost: EOR services come with a fee, which is typically a percentage of the employee’s salary.

- Less Control: You rely on the EOR for employment-related tasks, which may reduce direct control.

Contractors: Flexibility vs. Compliance Risks

Hiring contractors can provide flexibility when expanding internationally, but it also carries compliance risks.

Pros:

- Flexibility: Engage talent on a project basis, allowing you to scale your team up or down quickly.

- Cost-Effective: You only pay for the services provided, without the need for employee benefits or payroll taxes.

Cons:

- Misclassification Risks: Misclassifying employees as contractors can lead to legal and financial penalties.

- Limited Control: You have less control over contractors compared to employees, especially regarding work hours and methods.

- Compliance Challenges: Contractors are responsible for their own taxes and compliance, which can create administrative challenges.

Compliance Risk: Why Misclassification Isn’t Just a Paperwork Problem

One of the most critical, but often underestimated, risks in international hiring is employee misclassification. When businesses engage remote workers abroad as contractors, especially former employees, the structure can collapse under legal scrutiny if not properly managed. This is particularly true in countries like France and Spain, where labour authorities actively audit for disguised employment.

What is Disguised Employment?

Disguised employment occurs when someone is engaged as a contractor on paper but functions as a full-time employee in practice, reporting to your managers, working regular hours, and having no other clients. Many tax and social security authorities (e.g. URSSAF in France, Tesorería General in Spain) will ignore the contract label and apply a substance-over-form test. If the relationship resembles standard employment, they’ll reclassify it, and the consequences can be severe.

Key Compliance Triggers

- Single-client relationships (especially if the individual previously worked as an employee)

- Ongoing full-time engagement

- Lack of autonomy over work schedule or deliverables

- Use of company equipment or email domains

- Invoices without correct VAT treatment or registration details

The Hidden Cost of Getting It Wrong Reclassification can result in:

- Backdated employer social charges:

- ~30.9% in Spain

- 42–45% in France

- ~16.5% in Croatia

- Fines, interest, and late payment penalties

- Potential legal claims under local labour law (e.g. wrongful dismissal, paid leave entitlements, or severance)

- Reputational risk with local authorities and future hiring blocks in that market

These risks apply even if the individual agrees to freelance status, consent doesn’t override local labour law.

The EOR Advantage

Engaging an Employer of Record eliminates these risks. The EOR becomes the legal employer in the worker’s country, handling payroll, social contributions, contracts, and compliance. This makes sure the relationship passes legal muster under local employment frameworks, without burdening your business with the cost or complexity of entity setup.

EOR is particularly prudent when:

- You’re re-engaging former employees

- The worker is relocating to high-risk jurisdictions like France or Spain

- You want to scale quickly, without legal bottlenecks or tax exposure

Setting Up A Local Entity

Setting up a local entity involves establishing a legal presence in the target country, which can be a more complex but also potentially rewarding option.

When to Consider

- Long-Term Commitment: If you plan to operate in the country for the long term.

- Significant Operations: If you need to hire a large number of employees.

- Greater Control: If you want complete control over employment practices and HR management.

Why to Consider

- Tax Benefits: Local entities may qualify for tax incentives and benefits.

- Enhanced Credibility: Having a local presence can enhance your brand’s credibility in the market.

- Direct Customer Relationships: You can establish direct relationships with customers and partners in the region.

Expanding Into Ireland With EOR

Ireland has emerged as a strategic location for international businesses for several compelling reasons:

- English-speaking workforce

- EU membership providing access to the European market

- Highly educated talent pool

- Strong digital infrastructure

- Favorable business environment

- Growing tech and marketing sectors

With a corporate tax rate of 12.5% and a reputation as a business-friendly jurisdiction, Ireland has attracted numerous multinational corporations. The country’s skilled workforce makes it particularly attractive for marketing agencies seeking creative and technical talent.

Compliance Considerations For Hiring In Ireland

Hiring in Ireland, like any other country, comes with its own set of legal and compliance requirements. These include:

- Employment Contracts: Irish law requires written employment contracts outlining terms and conditions of employment.

- Working Hours and Holidays: Regulations exist regarding maximum working hours, rest periods, and statutory holidays.

- Minimum Wage: Ireland has a national minimum wage, which is subject to change.

- Taxation: Employers are responsible for deducting income tax (PAYE) and Pay Related Social Insurance (PRSI) from employee wages and remitting these to the Revenue Commissioners. You’ll want to make sure you’re claiming all your tax credits and reliefs as an employer.

- Data Protection (GDPR): Compliance with GDPR is crucial when handling employee data.

- Termination Procedures: Specific rules apply regarding notice periods and fair reasons for dismissal.

Staying on top of these regulations can be complex, especially if you’re not familiar with the Irish legal system. This is where an EOR with expertise in the Irish market becomes invaluable. Imagine trying to figure out PAYE and PRSI on your own – an EOR makes it simple.

How Marketing Agencies Benefit From EOR

Marketing agencies often face unique challenges when expanding internationally. They need to manage diverse talent pools, ensure compliance with local regulations, and maintain high levels of creativity and innovation. Here’s how EOR services can help:

- Streamlined Hiring Process: EOR services simplify the hiring process, allowing you to quickly onboard talent from around the world.

- Compliance Management: They ensure that your agency complies with all local employment laws, reducing the risk of legal issues.

- Focus on Core Activities: By outsourcing administrative tasks, you can focus on developing innovative marketing strategies and improving client satisfaction.

EOR Solutions For E-commerce & Tech

From scaling quickly to meet demand to managing complex regulations, these businesses need effective strategies to succeed. Employer of Record services provide a powerful tool for managing these complexities, offering streamlined hiring, global talent access, and compliance management.

E-commerce and SaaS Expansion Challenges

E-commerce brands and tech companies face their own set of challenges when growing internationally:

- Rapid scaling requirements to meet market demand

- Need for localised customer support across time sones

- Technical talent shortages in home markets

- Seasonal staffing fluctuations

- Complex regulatory requirements for digital products

A Strategic Advantage for Digital Businesses

EOR services offer particular advantages for digital businesses:

- Market Testing: Enter new markets with minimal investment, hiring a small local team before committing to full-scale expansion.

- Technical Talent Access: Overcome local talent shortages by hiring developers, engineers, and technical specialists internationally.

- Customer Support Scaling: Build 24/7 customer support teams across multiple time zones without establishing entities in each location.

- Seasonal Flexibility: Scale your team up during peak seasons (like holiday shopping periods) without the complexity of international hiring and offboarding.

- Regulatory Navigation: Ensure compliance with varying international regulations regarding digital products, data privacy, and consumer protection.

For e-commerce businesses concerned about tax efficiency, our article on ‘Are You Claiming All Your Tax Credit And Reliefs?’ provides valuable information on maximising your financial position.

A Step-By-Step Guide To Using EOR Services

As you expand your business globally, using Employer of Record services can significantly streamline your international hiring process. However, understanding the intricacies of EOR implementation is crucial for maximising its benefits.

Step 1: Assess Your Needs

Before looking for an EOR provider, clearly define:

- Which countries you need to hire in

- How many employees you anticipate in each location

- What roles and skills you require

- Your timeline for expansion

- Your budget constraints

This assessment helps you select the right EOR partner and prepare for implementation.

Step 2: Choose the Right Employer of Record Provider

Consider these factors when selecting an EOR provider:

- Geographic Coverage: Make sure they operate in all your target countries

- Industry Experience: Look for providers familiar with marketing agencies or e-commerce businesses

- Technology Platform: Evaluate their systems for payroll, onboarding, and HR management

- Support Quality: Assess responsiveness and expertise of their customer service

- Pricing Structure: Compare costs across providers (typically 8-15% of salary)

- Additional Services: Consider whether they offer recruitment, benefits administration, or other value-adds

Step 3: Onboarding Process

Once you’ve selected a provider, the general implementation process includes:

- Service Agreement: Sign a contract with the EOR provider outlining services and fees

- Employee Information Collection: Gather necessary details about your international hires

- Compliance Review: The EOR assesses employment terms for compliance with local laws

- Contract Preparation: Employment contracts are drafted according to local requirements

- Employee Onboarding: New team members complete required documentation

- Payroll Setup: Salary, tax, and benefit systems are established

This process usually takes 1-2 weeks, after which your international employees are legally employed and ready to work.

Step 4: Ongoing Management

After implementation, your relationship with the EOR involves:

- Regular Payroll Processing: The EOR handles salary payments, tax withholding, and required reports

- HR Support: The EOR manages employment changes, performance issues, and legal requirements

- Benefit Administration: Employee benefits are managed according to local requirements

- Compliance Updates: The EOR ensures your employment practices remain compliant as laws change

- Expansion Support: Additional employees can be added through the same processes

Step 5: Integration with Your Systems

For seamless operations, integrate the EOR with your existing systems:

- Project Management Tools: Ensure international employees can access your workflow systems

- Communication Platforms: Establish clear channels for team collaboration

- Financial Systems: Integrate with accounting software for financial visibility

- Performance Management: Include international employees in your review processes

The Financial Benefits Of Using EOR Services

Using Employer of Record services can have significant financial benefits for your business. Here’s how:

- Cost Savings: By avoiding the setup and operational costs of a local entity, you can save substantial amounts of money.

- Efficiency and Productivity: Outsourcing administrative tasks allows you to focus on revenue-generating activities, improving overall efficiency and productivity.

- Integration with Accounting Software: EOR services can integrate seamlessly with accounting software like Xero, ensuring that your financial management remains streamlined and efficient.

The global talent landscape has transformed how businesses operate. Employer of Record services have emerged as a critical tool for companies looking to take advantage of international talent without the burdens of global entity management.

By partnering with an EOR, businesses can:

- Ensure compliance with local employment laws

- Reduce the costs and time associated with international expansion

- Access global talent pools

- Scale teams efficiently based on business needs

- Focus on core business activities rather than administrative tasks

As remote work continues to shape the future of employment, EOR services will play an increasingly important role in helping businesses build effective international teams. Whether you’re a marketing agency looking to access specialised talent or an e-commerce brand expanding into new markets, Employer of Record services offer a streamlined path to global growth.

Ready to explore how an Employer of Record can help your business expand internationally? Contact us for personalised guidance on selecting the right Employer of Record provider for your specific needs.

FAQs

What exactly does an EOR do?

An EOR handles all legal and administrative aspects of employment, including payroll, tax compliance, benefits administration, and HR support, allowing you to hire internationally without establishing a legal entity in each country.

How much do EOR services typically cost?

EOR services generally cost between 8-15% of the employee’s salary, depending on the country, the number of employees, and the specific services included. This fee is significantly less than the cost of establishing and maintaining a legal entity.

Can I transition from an EOR to my own legal entity later?

Yes, most EOR providers support transitioning employees to your own entity if you decide to establish one in the future. This makes EORs an excellent starting point for market entry before committing to a permanent presence.

How quickly can I hire through an EOR?

Most EOR providers can complete the hiring process within 1-2 weeks, compared to the months required to establish a legal entity. This rapid deployment is particularly valuable for time-sensitive projects or competitive talent markets.

Do employees know they’re hired through an EOR?

Yes, employees understand they are legally employed by the EOR while working for your company. However, an EOR provider ensures a seamless experience that aligns with your company culture and expectations.

Can EORs help with recruiting talent?

Some EOR providers offer recruitment services as an additional offering, while others focus solely on employment administration. If you need help finding talent, look for an EOR that provides recruiting support or partners with local staffing agencies.

How do EORs handle employee benefits?

EORs provide statutory benefits required by local law and can often administer supplementary benefits you wish to offer. They ensure benefits compliance while allowing you to maintain competitive offerings to attract top talent.

What happens if I need to terminate an international employee?

EORs manage terminations according to local labor laws, ensuring compliance and minimising potential legal issues. They handle required notices, severance pay, and other termination-related tasks.