Poor preparation destroys even the strongest business ideas when it comes to loan applications. Financial projections that look hastily prepared or unrealistic immediately signal inexperience to lenders. What’s frustrating is knowing that most rejections could be avoided with proper preparation and professional presentation.

Startup business loans in Ireland can make or break your entrepreneurial journey. The difference between approval and rejection often comes down to preparation, not just the strength of your idea. Ireland’s startup scene is booming – we’ve got over 8,000 new companies registering annually, and access to funding has never been more diverse.

But most founders think getting a loan is about having a great idea. It isn’t. It’s about proving you can turn that idea into predictable cash flow while managing risk effectively.

The Irish lending landscape has evolved dramatically. Government-backed schemes offer competitive rates. Fintech lenders provide speed and flexibility. Traditional banks still play a crucial role for established founders. The key is knowing which option fits your specific situation and how to present yourself professionally.

Let me walk you through everything you need to know about securing startup business loans in Ireland – from choosing the right lender to avoiding the mistakes that tank applications.

Types Of Startup Business Loans Available In Ireland

The Irish startup funding ecosystem offers more options than ever before. Each type serves different business stages, risk profiles, and funding requirements.

Government-Backed Loans

Microfinance Ireland:

- Loan amounts: €2,000 to €50,000

- Interest rates: approximately 6.5% APR

- Repayment terms: up to 3 years

- Additional support: business mentoring included

Microfinance Ireland is a key lender catering to startups and small businesses that may be considered too risky by traditional banks. It operates in partnership with Local Enterprise Offices (LEOs), which provide grants and mentoring but do not issue loans themselves. LEOs support startups by offering grants and business advice to complement the loan products available through Microfinance Ireland.

Strategic Banking Corporation of Ireland (SBCI):

- Loan amounts: €25,000 to €3 million (via partner lenders)

- Focus: growth-stage businesses with established revenue

- Sectors: particularly strong for tech startups and innovation-driven companies

The SBCI facilitates low-cost funding for SMEs through a network of partner banks and approved on-lenders, rather than lending directly. To access SBCI-backed loans, startups and businesses must apply through one of the partnered banks such as AIB, Bank of Ireland, or PTSB. These loans are designed to support growth-stage businesses and innovation-driven sectors, providing competitive rates and flexible terms.

Bank Loans

Traditional banks offer larger loan amounts and established processes but require stronger financial positions.

Bank of Ireland and AIB:

- Loan amounts: €5,000 to €300,000

- Requirements: detailed business plans, personal guarantees

- Processing time: 4-8 weeks generally

- Strengths: comprehensive business banking relationships

Alternative Finance

Fintech lenders have transformed startup funding by offering speed and flexibility.

Wayflyer:

- Focus: e-commerce and online businesses

- Funding model: revenue-based financing

- Amounts: €10,000 to €10 million

- Speed: approval within days, not weeks

BusinessLoans.ie:

- Function: broker platform connecting startups with multiple lenders

- Advantages: single application, multiple offers

- Processing: streamlined comparison shopping

Revenue-Based Financing & Crowdfunding

Revenue-Based Financing:

- Best for: SaaS businesses, subscription models

- Structure: repayment based on monthly revenue percentage

- Advantages: no fixed monthly payments, aligns with cash flow

- Platform connecting startups and growing businesses in Ireland

- Offers flexible financing options including revenue-based financing

- Marketplace for exploring various funding solutions tailored to business needs

Summary of options:

- Loan sizes: €2,000 to €3 million+ depending on lender and business stage

- Interest rates: 6.5% to 15% APR depending on risk and lender type

- Repayment terms: 1 to 7 years, with revenue-based options offering flexible structures

Additional support: government schemes often include mentoring and business development resources

Where To Apply For Startup Business Loans In Ireland (2025 Options)

Choosing the right lender significantly impacts your approval chances and loan terms.

Government and Semi-State Lenders

Microfinance Ireland

- Best for: new businesses with limited trading history

- Typical approval time: 4-6 weeks

- Unique advantage: accepts applications others might reject

Local Enterprise Office (LEO)

- Best for: businesses creating local employment

- Approval time: 6-10 weeks including due diligence

- Additional benefits: ongoing mentorship, networking opportunities

Strategic Banking Corporation of Ireland (SBCI)

- Best for: growth-stage businesses with established revenue

- Focus sectors: technology, innovation, export-oriented businesses

- Loan amounts: €25,000 to €3 million

Traditional Banks

Bank of Ireland and AIB

- Strengths: comprehensive business banking relationships

- Best for: established founders with good credit history

- Process: relationship-based, requires detailed financial documentation

Alternative Lenders

Wayflyer

- Specialisation: e-commerce and online businesses

- Speed: approval within 24-48 hours

- Requirements: 6+ months trading history, online sales data

BusinessLoans.ie

- Function: broker platform

- Advantage: single application, multiple lender responses

- Best for: comparing options without multiple credit checks

Suitability guide by business type:

- E-commerce businesses: Wayflyer, BusinessLoans.ie

- Tech startups: SBCI, LEO, specialist tech lenders

- Service businesses: Microfinance Ireland, traditional banks

- First-time founders: Microfinance Ireland, LEO

Growth-stage companies: SBCI, traditional banks

What You’ll Need Before You Apply (Application Checklist)

Preparation determines success more than any other factor in startup business loans in Ireland applications.

Essential Documentation

Detailed Business Plan

Your business plan must answer three critical questions: what problem you solve, how you’ll make money, and why you’ll succeed.

Required sections:

- Executive summary (2 pages maximum)

- Market analysis with addressable market size

- Competitive analysis showing your differentiation

- Revenue model with clear pricing strategy

- Operations plan including key personnel

- Risk analysis and mitigation strategies

Financial Forecasts and Projections Lenders scrutinise your numbers more than any other element.

Required financial documents:

- 3-year profit and loss projections

- Cash flow forecasts (monthly for year 1, quarterly for years 2-3)

- Break-even analysis

- Sensitivity analysis showing best/worst case scenarios

Personal and Business Financial Statements

- Personal bank statements (6 months minimum)

- Credit report and score

- Business bank statements since inception

- Revenue correspondence and tax compliance certificates

Application Checklist

Before you apply:

- Complete business plan with executive summary

- 3-year financial projections with monthly cash flow for year 1

- Personal and business bank statements (6+ months)

- Credit report obtained and reviewed

- Tax compliance certification from Revenue

- Professional references contacted and confirmed

- All documents professionally formatted using tools like Xero

How Around Finance assists: Professional presentation significantly improves approval chances. Around Finance helps startups by creating professional financial projections, reviewing business plans for lender appeal, and providing CFO services to strengthen financial management.

Common Pitfalls That Cause Loan Applications To Be Rejected

After reviewing hundreds of applications, I see the same mistakes repeatedly.

Weak or Vague Business Plans

What goes wrong:

- Generic business descriptions without clear value propositions

- Market analysis lacking specific data and research

- Missing competitive analysis or unrealistic competitor assessments

How to fix it:

- Research your market thoroughly with specific data sources

- Define your target customer with detailed demographics

- Explain exactly how you’ll reach and acquire customers

Unrealistic Financial Projections

Common mistakes:

- Revenue growth rates exceeding industry norms without justification

- Underestimating customer acquisition costs and sales cycles

- Missing key expense categories like insurance and professional services

Creating realistic projections:

- Research industry benchmarks for revenue growth

- Include detailed customer acquisition cost calculations

- Account for all operating expenses including professional services

Poor Credit History Without Mitigation

Addressing credit concerns:

- Obtain your credit report before applying

- Prepare written explanations for any negative items

- Show evidence of improved financial management

- Consider offering additional security or guarantees

Inadequate Cash Flow Planning

Cash flow planning essentials:

- Monthly cash flow projections for at least 12 months

- Clear understanding of seasonal variations

- Contingency planning for slow-paying customers

- Multiple scenarios showing cash flow under different conditions

What To Do If You’re Rejected

Loan rejection isn’t the end of your funding journey.

Revenue-Based Financing Options

How it works:

- Lenders advance capital based on future revenue projections

- Repayments calculated as percentage of monthly sales

- No fixed monthly payments during slow periods

- Faster approval process than traditional loans

Alternative Funding Approaches

Government grants:

- Enterprise Ireland HPSU grants up to €90,000

- LEO business expansion grants

- Trading online vouchers for e-commerce development

Angel investors and crowdfunding:

- Private investors who provide equity funding

- Equity crowdfunding through platforms like Crowdcube

- Community-supported funding for local businesses

Building Towards Future Applications

Improving your profile:

- Build trading history and revenue growth

- Strengthen financial management and reporting

- Develop customer testimonials and case studies

- Create systems that reduce business risk

Government grants don’t require repayment but often have specific eligibility requirements. The Complete Guide To Every Business Grant And Support Available In Ireland provides detailed information on all available funding options beyond traditional loans.

Comparing Loan Providers

Choosing between loan providers requires comparing more than just interest rates. The total cost of borrowing, speed of access, and additional support can significantly impact your business success.

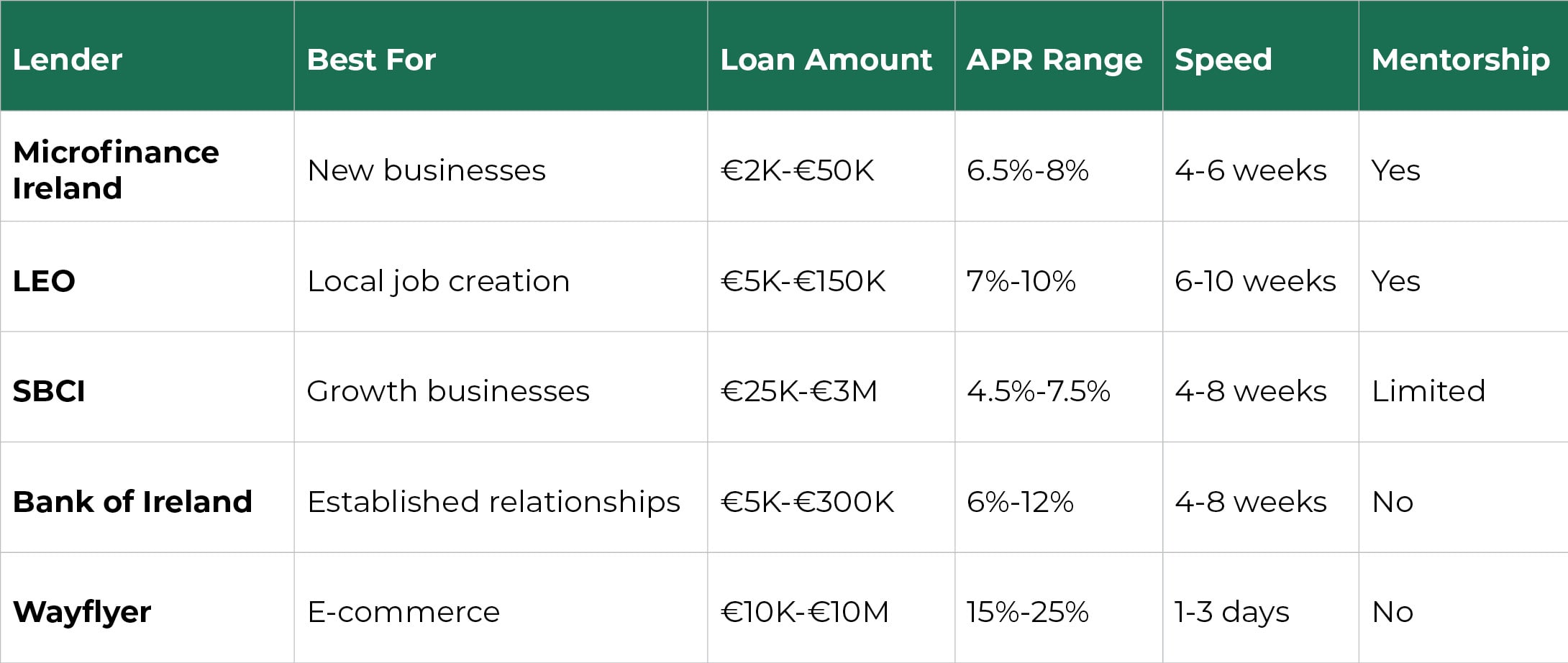

Loan Provider Comparison Table

Decision Framework

Choose government-backed lenders when:

- You need lower rates and flexible terms

- Your business creates local employment

- You value mentorship and ongoing support

Choose traditional banks when:

- You need comprehensive business banking relationships

- You have strong credit history and established business

- You require larger loan amounts

Choose alternative lenders when:

- Speed is critical to your business

- You have non-traditional business models

- Traditional lenders have rejected your application

Take Control Of Your Startup Funding Journey

Startup business loans in Ireland offer genuine opportunities for founders who approach them professionally and strategically. The key isn’t having a perfect business – it’s about preparation, realistic planning, and choosing the right funding partner.

This week:

- Obtain your credit report and review it thoroughly

- Research three suitable lenders based on your business type

- Start gathering essential documents from our checklist

- Calculate realistic financial projections

This month:

- Complete a professional business plan

- Create detailed financial projections with multiple scenarios

- Submit applications to your chosen lenders

The Irish startup ecosystem wants to support ambitious founders. Government schemes, alternative lenders, and traditional banks all play important roles. Your job is matching your business profile with the right funding partner and presenting your case professionally.Ready to secure the funding your startup deserves? Contact us to discuss how we can help you prepare winning loan applications and build financial foundations for sustainable growth.

FAQs

How hard is it to get a business loan as a first-time founder in Ireland?

Getting a startup business loan in Ireland as a first-time founder is challenging but achievable with proper preparation. Government-backed schemes like Microfinance Ireland specifically support new founders with more flexible criteria than traditional banks.

Can I get a startup loan with no revenue yet?

Yes, several Irish lenders provide pre-revenue startup loans. Microfinance Ireland and LEO programmes specifically support businesses at idea stage with solid business plans.

Are there startup loans with mentoring included?

Government-backed loan programmes typically include business mentoring. Microfinance Ireland provides ongoing business support throughout your loan term.

Do I need to be an Irish citizen to qualify?

Irish citizenship isn’t required for most business loans, but you typically need to establish your business in Ireland and demonstrate commitment to the Irish market.

Can I apply for multiple funding options simultaneously?

Yes, applying to multiple lenders simultaneously is common and recommended. Different lenders have varying criteria and risk appetites.