Something clicked for me last year when I was reviewing quarterly numbers and saw a pattern emerging across e-commerce businesses. Marketing spend that looked expensive on paper was actually generating massive returns when calculated properly. A €45,000 quarterly marketing investment that seemed costly was actually delivering €180,000 in customer lifetime value. That’s when I realised we weren’t looking at marketing costs anymore – we were looking at financial assets.

This shift changes everything. The financialisation of marketing means treating your marketing spend like any other investment in your business. Just as you wouldn’t buy equipment without calculating ROI, you shouldn’t run campaigns without measuring their financial return.

The first step as a business owner is to step back and ask the question: What game am I playing? Where you are at will dictate how aggressive you can play the game of marketing. Can you wait six months for lifetime value (LTV) to ROI, or do you need first order profitability?

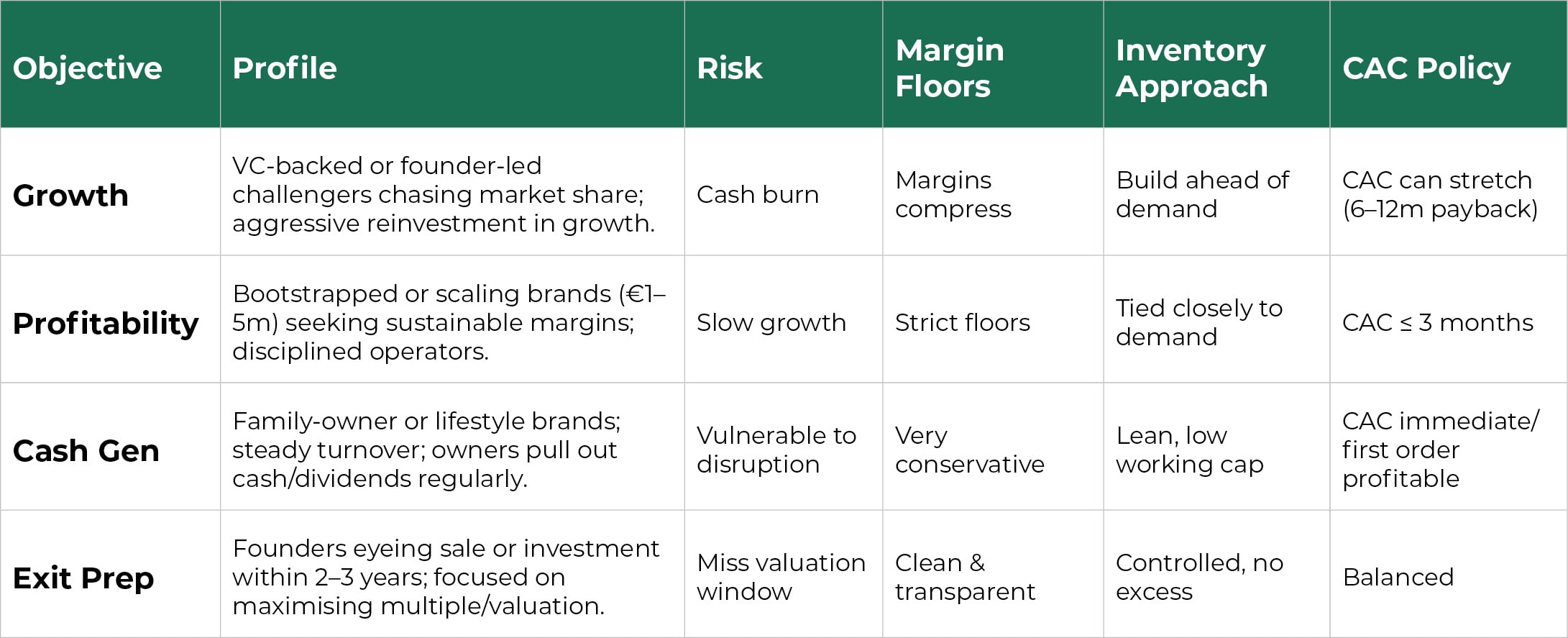

To understand this better, it helps to identify your current core business objective. The table below outlines four common objectives, each with typical profiles, risks, margin floors, inventory strategies, and customer acquisition cost (CAC) policies:

Knowing where you fit in this framework allows you to manage your marketing spend in line with your business goals. For example, a high-growth VC-backed business can afford more aggressive CAC payback periods and higher cash burn, whereas a family-owned business focused on generating cash will need tighter controls and faster returns.

The pressure is real for Irish SMEs. Rising costs, tighter margins, and increased competition mean every euro spent on marketing must work harder. The businesses that succeed are those treating marketing as an investment rather than an expense.

Let me show you exactly how to make this shift in your business.

What Is The “Financialisation Of Marketing”?

The financialisation of marketing transforms how you view every pound spent on customer acquisition. Instead of seeing marketing as a necessary cost, you start treating it as a financial instrument that generates measurable returns.

Think of it this way – when you buy inventory, you expect to sell it for more than you paid. The financialisation of marketing applies the same logic to customer acquisition. Every campaign becomes an investment with expected returns, risk profiles, and performance metrics.

Key financial indicators that matter:

- Return on Investment (ROI) – total revenue divided by marketing spend

- Customer Lifetime Value (CLV) – total profit from a customer over their relationship with your business

- Return on Ad Spend (ROAS) – immediate revenue generated per pound spent on advertising

- Payback on Ad Spend (POAS)

- Customer Acquisition Cost (CAC)

- Net Customer Acquisition Cost (NCAC)

- Contribution Margin — arguably the most important metric

- LTV:CAC ratio – lifetime value compared to customer acquisition cost

Here’s what makes this approach transformative. Traditional marketing focuses on impressions, clicks, and engagement. Financial marketing focuses on profit margins, cash flow impact, and return on capital. The difference in results is dramatic.

When you view marketing through a financial lens, every decision becomes data-driven. Should you increase your Facebook ad budget? The LTV:CAC ratio tells you. Is that influencer partnership worth it? The expected ROI calculation gives you the answer.

Why The Shift Matters For E-Commerce In 2025

Irish e-commerce businesses face unprecedented challenges this year. Inflation has pushed up everything from shipping costs to digital advertising rates. Consumer spending is more cautious. Competition from international brands continues to intensify.

Market pressures driving change:

- Rising acquisition costs – Facebook and Google ads cost 25% more than they did in 2022

- Squeezed margins – supply chain inflation eating into profits

- Cash flow uncertainty – customers taking longer to pay, seasonal fluctuations more pronounced

- Increased competition – more businesses fighting for the same customers

- Post-COVID drop in some demand segments

- The rapid growth of marketplaces competing aggressively for direct-to-consumer (D2C) traffic

- Increasing worldwide tariffs adding complexity and costs to cross-border trade

The fastest-growing Irish e-commerce businesses I work with have adapted by treating marketing spend like venture capital. They fund customer acquisition from measurable profit pools. They calculate exact returns before committing budgets. They stop campaigns that don’t hit target ROI thresholds.

Consumer behaviour changes accelerating this shift:

- Customers research more before buying

- They expect personalised experiences

- They’re more price-sensitive

- They switch brands more easily

AI and automation tools make precise measurement possible at scales that weren’t feasible before. You can now track individual customer journeys, predict lifetime values with accuracy, and optimise campaigns in real-time based on profit margins.

Government digital initiatives through Revenue and Enterprise Ireland provide grants specifically for e-commerce marketing technology. Smart businesses use these funds to build the measurement infrastructure that supports marketing as an investment strategies.

How To Measure “Marketing As An Investment”

Measuring marketing as an investment requires different tools and metrics than traditional marketing measurement. You need to connect marketing activities directly to financial outcomes.

Essential measurement tools:

Customer Lifetime Value (CLV) Analysis

CLV predicts how much profit each customer will generate over their entire relationship with your business. Calculate it by multiplying average order value, purchase frequency, and customer lifespan, then subtracting your costs.

Simple CLV formula: Average Order Value × Purchase Frequency × Customer Lifespan × Gross Margin = CLV

Another critical dimension is first order profitability. For many businesses, achieving profitability on the first order within key timeframes – such as 3 months or 6 months -can be decisive for cash flow and marketing budget decisions. This means measuring how quickly marketing spend translates into net positive returns, not just long-term customer value.

By combining CLV with these time-sensitive profitability measures, you gain a clear and actionable view of marketing as a financial investment rather than just a cost.

Attribution Modelling

This tracks which marketing touchpoints contribute to conversions. Instead of giving all credit to the last click, attribution modelling shows the complete customer journey.

Cohort Analysis

Group customers by acquisition date and track their behaviour over time. This reveals which marketing channels attract the most valuable long-term customers.

Key KPIs for financial marketing:

- Contribution

- Return on Ad Spend (ROAS) / Payback on Ad Spend (POAS)

- LTV to Net Customer Acquisition Cost ratio (LTV/NCAC)

- LTV:CAC ratio – aim for 3:1 minimum, ideally 4:1 or higher

- Margin on ad spend – gross profit generated per pound of advertising

- Channel ROI – which marketing channels deliver highest returns

- Payback period – how quickly marketing spend pays for itself

- Campaign Profitability

Here’s an example that illustrates this perfectly. Consider an e-commerce business where email marketing shows lower immediate ROAS than Facebook ads. But cohort analysis might reveal email customers have 40% higher lifetime values. When you calculate true ROI, email marketing could actually be the most profitable channel.

Integrating with accounting software:

Modern tools like Xero connect directly with marketing platforms. This gives real-time visibility into campaign profitability. You can see which campaigns contribute to cash flow and which ones drain resources.

Setting up automated reporting:

- Connect your e-commerce platform to your accounting system

- Tag customers by acquisition channel

- Track revenue and costs by marketing campaign

- Calculate ROI automatically for each channel

The goal is instant visibility. When you check your dashboard, you should see exactly which marketing activities generate profit and which ones need adjustment.

E-Commerce Marketing Profitability Levers

E-commerce marketing profitability depends on optimising a couple of financial levers simultaneously. Most businesses focus on acquisition costs but ignore the other factors that drive profitability.

One of the most important metrics to understand is Contribution Margin.

Revenue is vanity; profit is sanity. In e-commerce, contribution margin is your money – your true profit before accounting for operating costs and fixed overheads. Knowing your contribution margin is crucial before focusing on metrics like ROAS.

To calculate contribution margin accurately, consider these components:

- Sales including VAT

- VAT

- Sales excluding VAT

- Shipping income

- Discounts

- Refunds

- Cost of Goods Sold (COGS)

- Shipping costs (last mile)

- Transaction fees

- Fulfillment costs

- Marketing spend (Customer Acquisition Cost, CAC)

Contribution Margin represents your e-commerce profit before operating expenses and fixed overheads. It shows how much money is actually available to cover your fixed costs and generate profit.

Retention strategies that multiply ROI:

Retention is where e-commerce marketing profitability really accelerates. Acquiring a customer costs five times more than retaining one. Here’s how to optimise retention:

- Email automation sequences that guide customers through repurchase cycles

- Subscription models that guarantee recurring revenue

- Loyalty programmes that increase average order values

- Personalisation engines that recommend relevant products

Managing product margins effectively:

Different products have different margins. Your marketing should prioritise high-margin items. Use dynamic pricing to optimise profitability:

- Promote high-margin, fast-selling products actively with paid ads

- Use upselling automation to boost order values, especially for low-margin, fast-selling items

- Bundle slower-moving products – group low-margin products with higher-margin ones to lift overall basket margins

- Test promotions on high-margin, slow-selling products to find the right balance

- Phase out or clear out low-margin, slow-moving products by using them as gifts with purchase (GWP) or through liquidation sales

Strategy at a glance:

- High Margin + Fast = Push aggressively with ads

- Low Margin + Fast = Use as upsell drivers but monitor carefully

- High Margin + Slow = Bundle and test promotions

- Low Margin + Slow = Kill or clear as GWP/liquidation

Fulfilment cost optimisation:

Shipping and handling costs directly impact e-commerce marketing profitability. Strategies that work:

- Free shipping thresholds that increase average order values

- Regional warehousing to reduce delivery costs

- Automated inventory management to reduce storage costs

- Returns process optimisation to minimise losses

Examples from Irish e-commerce brands:

Consider an Irish fashion retailer that could increase profitability 35% by shifting marketing focus from acquisition to retention. By reducing new customer advertising spend by 20% while increasing customer lifetime values through personalised email campaigns and loyalty rewards, the results would be substantial.

A home goods business might optimise their product mix for marketing campaigns. Instead of promoting low-margin bestsellers, focusing campaigns on high-margin seasonal items could improve marketing ROI from 2.8:1 to 4.2:1.

Five New Financialisation Strategies For 2025

These financialisation of marketing strategies are already working for forward-thinking Irish SMEs. Each one treats marketing spend like a financial instrument with measurable returns.

1. AI-Enabled Spend Forecasting

Use predictive algorithms to optimise marketing budgets based on margin thresholds. Instead of fixed monthly budgets, spend dynamically based on profitability.

How it works:

- AI analyses historical performance data

- Predicts optimal spend levels for each channel

- Automatically adjusts budgets when profit margins hit predetermined levels

- Pauses spending when returns fall below acceptable thresholds

Implementation for Irish SMEs: Start with tools like Google’s Smart Bidding or Facebook’s Campaign Budget Optimisation. Connect these to your Xero accounting data for real-time profitability visibility.

2. Capital-Backed Campaign Financing

Fund customer acquisition like capital investments, especially valuable for SaaS and subscription businesses.

The approach:

- Calculate expected customer lifetime value

- Secure funding based on predicted returns

- Invest heavily in acquisition during optimal periods

- Use debt or equity structures designed for marketing investments

Example application: An Irish SaaS company could use this approach to fund a €100,000 marketing campaign. With CLV of €800 per customer and acquisition costs of €150, securing financing against predicted returns becomes a viable strategy.

3. Securitisation of Customer Contracts

Convert recurring revenue streams into tradable financial assets. This works particularly well for subscription and contract-based businesses.

The process:

- Package customer contracts with predictable revenue streams

- Create financial instruments based on these contracts

- Use the capital to fund additional customer acquisition

- Scale acquisition without depleting cash reserves

4. Embedded Finance for Upselling

Integrate purchase credits and offers at the point of sale, tied directly to profit margins.

Implementation ideas:

- Offer financing for higher-value purchases

- Create credit systems that encourage larger orders

- Implement buy-now-pay-later options that increase conversion rates

- Use margin-based pricing for financial products

5. Real-Time Ledger Visibility

Connect marketing dashboards directly with finance systems for instant profit and loss insights.

Technical setup:

- Integrate marketing platforms with accounting software

- Create automated profit calculations for each campaign

- Set up alerts when campaigns fall below profitability thresholds

- Build dashboards that show real-time financial impact

Tools that enable this: Modern accounting platforms like Xero offer APIs that connect with marketing tools. This creates the real-time visibility essential for treating marketing as an investment.

Additional specialised tools include:

- SYFT Analytics – purpose-built for financial analytics and visibility tailored to e-commerce.

- Store Hero – provides integrated marketing and finance insights with real-time profitability tracking.

These integrations allow businesses to monitor campaign-level profitability instantly and adjust spend based on real financial impact, moving beyond traditional vanity metrics.

Building A Financialised Marketing Organisation

Organisational structure determines whether financialisation of marketing succeeds or fails. You need people who understand both marketing and finance working together.

Key roles to consider:

Marketing Investment Analyst

This person calculates ROI for every campaign, manages budget allocation based on financial returns, and identifies optimisation opportunities.

Responsibilities:

- Develop ROI models for each marketing channel

- Create financial forecasts for marketing investments

- Monitor campaign performance against financial targets

- Recommend budget reallocations based on performance data

Financial Operations Lead

Connects marketing activities to business financial outcomes, manages marketing budgets like an investment portfolio.

Core tasks:

- Track marketing spend against profit generation

- Calculate lifetime value for different customer segments

- Manage cash flow impact of marketing investments

- Report marketing financial performance to leadership

Margin Strategist

Focuses specifically on e-commerce marketing profitability by optimising product mix, pricing, and campaign targeting.

Focus areas:

- Identify highest-margin products for marketing priority

- Develop pricing strategies that support marketing goals

- Optimise product bundles for campaign promotion

- Analyse margin impact of different marketing channels

Structuring teams around profit:

Traditional marketing teams organise around channels – someone runs Facebook ads, another manages email marketing. Financial marketing teams organise around profit centres.

Team structure that works:

- Acquisition team focused on channels with best LTV:CAC ratios

- Retention team optimising customer lifetime value

- Analytics team measuring financial performance across all activities

- Operations team connecting marketing to business systems

KPI-based compensation models:

Align team incentives with financial outcomes. Instead of paying bonuses based on clicks or impressions, tie compensation to:

- Marketing ROI achievement

- Customer lifetime value improvements

- Profit margin optimisation

- Cash flow contribution from marketing activities

This creates an investment mindset throughout your marketing organisation. Everyone thinks about financial returns, not just marketing metrics.

Monitoring And Adjusting Strategy In Real Time

Real-time monitoring separates successful financialisation of marketing from traditional approaches. You need systems that show immediate financial impact and allow quick adjustments.

Tools for real-time profitability tracking:

Connected Dashboards

Link your marketing platforms directly to your accounting software. When someone makes a purchase, you immediately see the profit impact and which marketing touchpoints contributed.

Automated ROI Calculations

Set up systems that calculate return on investment automatically. As soon as campaign data comes in, you know whether it’s profitable.

Profit-Based Alerts

Create notifications when campaigns fall below acceptable ROI thresholds. This allows immediate adjustments before significant money is wasted.

Agile budgeting techniques:

Traditional businesses set annual marketing budgets. Financial marketing uses dynamic budgeting based on performance:

Weekly performance reviews:

- Calculate ROI for each active campaign

- Identify underperforming channels for immediate adjustment

- Reallocate budget from poor performers to high-return activities

- Test new opportunities with small budget allocations

Pause/resume strategies: Build systems that automatically pause campaigns when they fall below profitability thresholds. This prevents continued losses from poor-performing activities.

Monthly financial analysis: Conduct deep analysis of marketing financial performance:

- Which channels contributed most to profit growth?

- How did customer acquisition costs change?

- What was the cash flow impact of marketing spend?

- Which campaigns showed best long-term customer value?

Response to market conditions:

Economic conditions change rapidly. Your marketing strategy must adapt accordingly:

During high-demand periods:

- Increase spend on proven high-ROI channels

- Test new acquisition channels with higher budgets

- Focus on premium products with better margins

- Accelerate retention campaigns to maximise customer value

During economic uncertainty:

- Reduce spend on experimental campaigns

- Focus budget on highest-certainty returns

- Increase retention marketing to protect existing customers

- Emphasise value propositions in messaging

Case study approach:

Consider an Irish e-commerce business implementing weekly strategy adjustments based on financial performance. During the Christmas season, reallocating 40% of budget from underperforming Facebook campaigns to high-converting email sequences could improve overall marketing ROI from 3.2:1 to 4.8:1.

A business might use automated pause rules where any campaign’s ROI falling below 2.5:1 for three consecutive days triggers automatic pausing. This approach prevents emotional decision-making and maintains consistent profitability standards.

Building Your Financialisation Of Marketing Framework

Creating a financialisation of marketing framework requires systematic implementation. Here’s the step-by-step approach that works for Irish SMEs.

Phase 1: Measurement Foundation

Start by connecting your marketing data to financial outcomes:

- Integrate your e-commerce platform with accounting software

- Set up customer tracking from acquisition through lifetime value

- Create automated ROI calculations for each marketing channel

- Establish baseline measurements for current marketing performance

Phase 2: Organisation Alignment

Restructure your team around financial outcomes:

- Train marketing team members on financial metrics

- Create compensation structures tied to ROI performance

- Establish regular financial review meetings

- Define roles focused on profitability rather than vanity metrics

Phase 3: Technology Integration

Implement tools that support real-time financial decision-making:

- Connect marketing platforms to Xero or similar accounting software

- Set up automated reporting dashboards

- Create profit-based campaign optimisation rules

- Establish alert systems for underperforming campaigns

Phase 4: Advanced Strategies

Once basics are working, implement sophisticated financialisation of marketing techniques:

- AI-powered budget optimisation

- Customer lifetime value prediction models

- Dynamic pricing integration with marketing campaigns

- Advanced attribution modelling across all touchpoints

Common implementation mistakes:

Over-complexity at the start: Many businesses try to implement every strategy simultaneously. Start with basic ROI measurement and build complexity gradually.

Ignoring cash flow timing: Marketing investments have different payback periods. Account for this in your financial planning.

Focusing only on immediate returns: Some marketing activities have longer payback periods but higher lifetime values. Balance immediate and long-term returns.

Not training the team: Financialisation of marketing requires new skills. Invest in training your team on financial metrics and decision-making.

For marketing agencies serving e-commerce clients, understanding these frameworks becomes essential for delivering results that clients can measure financially.

Transform Your Marketing Into A Profit Engine

The financialisation of marketing isn’t just a trend – it’s the new standard for successful e-commerce businesses. Companies that make this shift see dramatic improvements in marketing efficiency and overall profitability.

Here’s what you need to do starting today:

Immediate actions:

- Calculate current customer lifetime value for each acquisition channel

- Set up ROI tracking for all marketing campaigns

- Connect your marketing platforms to your accounting software

- Establish minimum ROI thresholds for continued campaign funding

This week:

- Review last quarter’s marketing spend against actual profit generation

- Identify which channels deliver highest long-term customer value

- Create simple dashboards showing marketing financial performance

- Train your team on financial metrics and decision-making

This month:

- Implement automated ROI calculations for all campaigns

- Restructure marketing budgets based on financial performance

- Set up profit-based alerts and optimisation rules

- Begin testing advanced marketing as an investment strategies

The businesses that embrace financialisation of marketing in 2025 will be the ones that survive and prosper in an increasingly competitive market. Those that continue treating marketing as unmeasured expense will find themselves at a severe disadvantage.

At Around Finance, we help e-commerce & retail businesses implement these financial frameworks alongside comprehensive accounting and advisory services. We understand the unique challenges facing Irish SMEs and provide the measurement systems and strategic guidance needed to treat marketing as an investment.

Ready to transform your marketing into a profit-generating asset? Contact us to discuss how we can help you implement financialisation of marketing strategies that deliver measurable financial returns.

FAQs

What does financialisation of marketing mean in e-commerce?

Financialisation of marketing means treating marketing spend like any other business investment. Instead of viewing marketing as a cost centre, you calculate specific financial returns, measure profit generation, and make decisions based on ROI data. Every campaign becomes a financial instrument with measurable returns.

How can I treat marketing as an investment on my books?

Track marketing spend as an asset that generates future returns rather than an immediate expense. Calculate customer lifetime value for each acquisition channel, measure payback periods for campaigns, and allocate budgets based on expected ROI. Use accounting software like Xero to connect marketing spend directly to revenue generation.

What metrics best show e-commerce marketing profitability?

Focus on LTV:CAC ratio (lifetime value to customer acquisition cost), return on ad spend (ROAS), customer payback period, and profit margin per acquisition channel. These metrics show actual financial returns rather than vanity metrics like clicks or impressions.

Why is e-commerce marketing profitability more important in 2025?

Rising advertising costs, increased competition, and economic uncertainty mean every marketing pound must work harder. Businesses that can’t prove marketing ROI will struggle to secure budgets and compete effectively. E-commerce marketing profitability measurement allows precise optimisation and sustainable growth.

What tools can help me forecast ROI before marketing spend?

Use AI-powered platforms that connect to your historical data for predictive analysis. Google Analytics 4 offers enhanced attribution, Facebook provides predictive lifetime value calculations, and accounting integration tools show real-time profitability. Combine these with cohort analysis for accurate forecasting.

Can marketing campaigns be funded similarly to capital investments?

Yes, especially for businesses with predictable customer lifetime values. You can secure financing against expected marketing returns, use invoice factoring against future customer contracts, or create investment structures specifically for customer acquisition. This approach works particularly well for SaaS and subscription businesses.

How do I structure my team to support marketing-as-investment strategies?

Create roles focused on financial outcomes rather than channel management. Hire marketing investment analysts who calculate ROI, financial operations leads who connect marketing to business outcomes, and margin strategists who optimise profitability. Align compensation with financial metrics rather than activity metrics.

What are some examples of marketing being treated as a financial asset?

Customer email lists are valued based on lifetime value potential, social media followings priced according to conversion rates, and subscription customer bases securitised as financial instruments. Some businesses sell future customer revenue streams to fund immediate acquisition campaigns.

How do you securitise revenue from subscription-based campaigns?

Package customer contracts with predictable revenue streams into financial instruments. Investment firms purchase these revenue streams at a discount, providing immediate capital for additional customer acquisition. This works best with annual contracts or high-retention subscription businesses.

What KPIs should finance and marketing partners track together?

Customer acquisition cost, lifetime value, payback period, marketing ROI, cash flow impact from campaigns, profit margin by acquisition channel, and customer retention rates. These metrics bridge the gap between marketing activities and business financial performance.