Let me tell you something that might surprise you. Most people working from home in Ireland are missing out on legitimate tax relief worth hundreds of euros annually. I see it constantly. – business owners and employees who’ve been working remotely for years without claiming a penny.

Here’s what frustrates me most. Revenue has made these reliefs available for good reason, yet so many people think they’re too complicated or not worth the effort. That’s simply not true.

Since 2020, remote working has shifted from emergency measures to permanent fixtures. The government recognises this. They’ve created specific tax reliefs to help offset the extra costs of working from home. But most people think it’s complicated. It isn’t. You just need to know the rules.

Let me walk you through everything you need to know about remote working relief in Ireland. By the end of this guide, you’ll know exactly how to claim what you’re entitled to, avoid the common mistakes I see daily, and potentially save hundreds of Euros in taxes.

Remote Working Is Here To Stay – So Are The Tax Benefits

Remote and hybrid working models have transformed Irish business since 2020. What started as a pandemic response has become the new normal. Companies in e-commerce, marketing agencies, and tech startups (the sectors I work with most) have embraced flexible working permanently.

Revenue adapted quickly. They introduced two main support mechanisms:

- Remote Working Relief – tax relief you claim yourself

- Employer allowances – tax-free payments your employer can make

The beauty of these reliefs? They acknowledge that working from home costs money. Your electricity bills increase. Your heating runs longer. Your broadband gets hammered. These aren’t trivial expenses – they add up fast.

What this guide covers:

- Both types of relief available

- Who qualifies and how

- Step-by-step calculation methods

- How to make your claims

- Advanced scenarios and pitfalls to avoid

What Is Remote Working Relief In Ireland?

Remote working relief comes in two flavours. Think of it like this – your employer can help you, or you can help yourself. Sometimes both.

Revenue defines “eworking” quite specifically. You must be working from home on a regular, consistent basis. This isn’t about the odd day here and there – it needs to be substantial and ongoing.

Here’s how the two reliefs work:

Option 1: Employer-Paid Allowance

Your employer can pay you €3.20 per day you work from home. This money is completely tax-free. No PAYE, no USC, no PRSI deductions. It goes straight into your pocket.

Option 2: Employee-Claimed Relief

You calculate your actual home office expenses and claim 30% of electricity, heating, and broadband costs as tax relief. This reduces your taxable income.

The key difference? The employer allowance is cash in hand. The employee relief reduces your tax bill.

Tax-Free Allowance vs Remote Working Relief: What’s The Difference?

Let me break this down with a practical example.

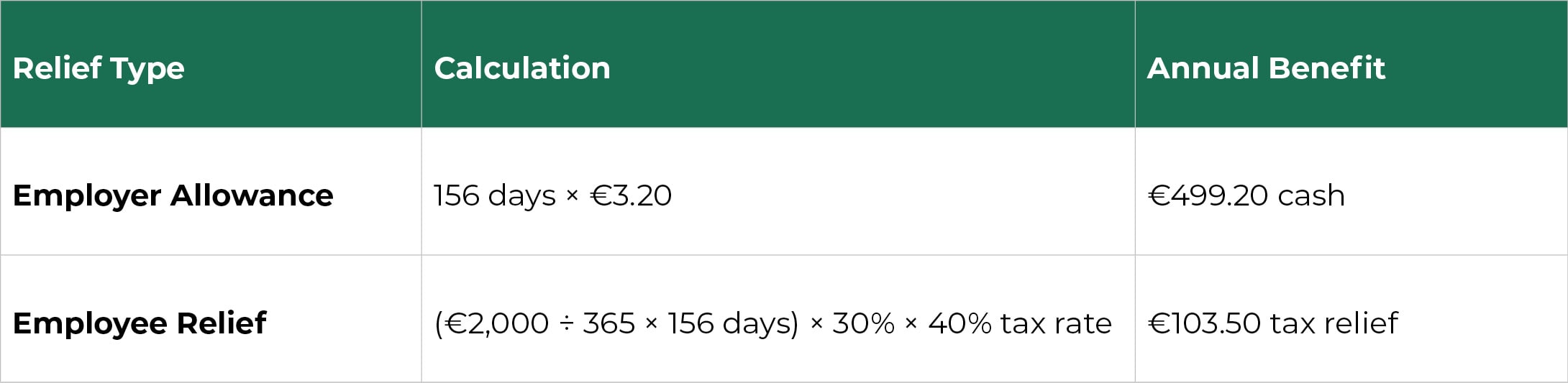

Take someone who works for a marketing agency three days per week from home. With annual utilities totalling €2,000, here’s how each option works:

The employer allowance wins every time for straightforward cases.

But here’s where it gets interesting. What if utilities are much higher? What if there are expensive broadband packages or more home-working days? The employee relief might make more sense.

You cannot claim both for the same days. This is crucial. Choose the option that gives you the bigger benefit.

Eligibility Criteria For Remote Work Tax Relief

I get asked about eligibility constantly. The rules are clearer than you might think.

For the employer allowance:

- You must work from home

- Your employer must be willing to pay it

- They need records of your home-working days

- That’s it

For employee relief:

- You must work from home regularly and substantially

- You need evidence of your utility costs

- Your employer should confirm your working arrangements

- You must maintain proper records

Self-employed individuals follow different rules entirely. You claim home office expenses through your business, apportioning costs between business and personal use.

Hybrid Working Calculations

Most people work hybrid schedules these days. Here’s how to calculate proportionate relief:

If you work 120 days from home out of 240 working days, you can claim for exactly 120 days. Simple as that.

The trick is keeping accurate records. A shared calendar or spreadsheet tracking home-working days works well. Your employer should confirm these arrangements in writing.

How To Calculate Your Working From Home Tax Relief

This is where people get confused. Let me show you a formula that works.

Step-by-Step Employee Calculation

Step 1: Gather your annual utility bills

- Electricity

- Gas/heating oil

- Broadband (business-related portion)

Step 2: Calculate daily costs

Total annual utilities ÷ 365 days = daily cost

Step 3: Apply working days

Daily cost × days worked from home = working-related utilities

Step 4: Apply allowable percentages

- Electricity and heating: multiply by 30%

- Broadband: multiply by 30%

Step 5: Calculate tax relief Total allowable costs × your tax rate (20% or 40%) = actual relief

Example

Let me show you how this works with actual numbers:

Michael’s Situation:

- Works 150 days from home annually

- Electricity: €800

- Gas heating: €900

- Broadband: €400

- Total utilities: €2,100

- Tax rate: 20%

Calculation:

- Daily cost: €2,100 ÷ 365 = €5.75

- Working-related: €5.75 × 150 days = €862.50

- Allowable costs: €862.50 × 30% = €258.75

- Tax relief: €258.75 × 20% = €51.75

Compare this to the employer allowance: 150 days × €3.20 = €480

The employer allowance is clearly better for Michael.

When Employee Relief Makes Sense

Employee relief typically works better when:

- You work from home most days

- Your utility bills are exceptionally high

- You have expensive business broadband

- Your employer doesn’t offer the daily allowance

How To Claim Remote Working Relief

The claiming process is straightforward once you know what you’re doing.

For PAYE Employees

Online through Revenue myAccount:

- Log into your myAccount

- Select ‘Review your tax’

- Choose ‘Employment and benefits’

- Find ‘Flat rate expenses’

- Add ‘eworking expenses’

- Enter your calculated amount

Required documentation:

- Utility bills covering the claim period

- Record of home-working days

- Employer letter confirming arrangements

For Self-Employed

Use Revenue Online Service (ROS) when filing your annual return:

- Include home office expenses under ‘Office expenses’

- Apportion utilities between business and personal use

- Maintain detailed records of the split

Timing Your Claims

You can claim:

- During the tax year through myAccount

- Retrospectively on your annual return

- Up to four years after the tax year ends

I always recommend claiming in-year. Why wait for your refund?

Remote Work Relief For Employers

If you’re an employer reading this, listen up. The €3.20 daily allowance is one of the best employee benefits you can offer.

Why offer it:

- Completely tax-free for employees

- Minimal administrative burden

- Shows you care about employee welfare

- Helps with recruitment and retention

How to implement:

- Track employee home-working days

- Pay allowance monthly with salary

- Process through payroll as a tax-free allowance

- Code as tax tax-free benefit on payroll

Key requirements:

- Maintain records of home-working days

- Don’t pay for office days

- Report correctly to Revenue

Compliance warning: Never double-pay. If you’re paying the allowance, employees cannot claim the tax relief for the same days. Make this clear to your team.

Remote Working Relief For The Self-Employed

Self-employed individuals play by different rules. Instead of claiming relief, you claim expenses.

How it works:

- Calculate proportion of home used for business

- Apply this percentage to utility bills

- Claim as legitimate business expense

- Reduce taxable profits accordingly

Example calculation:

- Home office is 10% of house

- Annual utilities: €2,400

- Business portion: €240

- Tax saving: €240 × your tax rate

I always recommend professional advice for substantial home office claims. The tax savings can be significant, but the rules are more complex than employee relief.

Advanced Scenarios And Pitfalls To Avoid

After years of helping clients with remote working relief, I’ve seen every mistake possible. Let me save you the headaches.

Multiple People in One Household

This comes up frequently. Two partners both work from home – can they both claim?

The answer: Yes, but be reasonable. You can’t both claim 100% of utilities. Split the working-related costs proportionally based on:

- Time spent working

- Space used

- Actual usage patterns

Switching Between Relief Types

You can change your approach year to year, but not mid-year for the same days. If your employer starts paying allowances in July, you can:

- Claim employee relief for January-June

- Take employer allowance from July onwards

Just keep clear records of the switch.

Co-working Spaces

Working from a co-working space doesn’t qualify for home office relief. Revenue is specific about this – the relief is for working from your residence.

The CGT Trap

For self-employed individuals claiming home office expenses, be careful about exclusive business use claims. If you designate a room as exclusively for business:

- You might face CGT when selling your home

- The business portion won’t qualify for principal private residence relief

Most accountants recommend claiming only shared use to avoid this issue.

Best Practices for Maximising Your Claim

Here’s how to maximise your remote working relief:

Maintain detailed records:

- Daily work calendar showing home vs office days

- All utility bills for claim periods

- Email confirmations from employers about working arrangements

- Photos of your home office setup

Regular review:

- Check your utility costs quarterly

- Reassess which relief type works better

- Update calculations if working patterns change

- Consider seasonal variations in heating costs

Professional organisation: Create a dedicated folder (physical or digital) for all remote working documents. When Revenue asks questions, you’ll be ready.

Annual optimisation: Review your relief calculations each January:

- Did your utility costs change?

- Are you working from home more or less?

- Has your employer introduced new allowances?

- Should you switch relief types?

Software integration: If you use Xero or similar accounting software, set up expense categories for home office costs. This makes annual calculations much easier.

Will Remote Work Relief Still Be Available In 2025 And Beyond?

Based on government statements and budget announcements, remote working relief looks permanent. The shift to hybrid working has been too significant to reverse.

Recent developments:

- Relief rates have remained stable

- Eligibility criteria haven’t tightened

- Government continues supporting flexible working

- EU directives encourage remote working rights

Future considerations:

- Potential integration with green energy incentives

- Possible increases to daily allowance rates

- Enhanced support for rural remote working

- Connection to broader cost-of-living measures

My prediction? These reliefs will expand, not contract. The economic and social benefits of remote working are too clear to ignore.

When To Talk To A Tax Adviser

Most remote working relief claims are straightforward. But some situations need professional help:

Complex scenarios requiring advice:

- Mixed-use homes with substantial business areas

- Multiple family members all working from home

- High-value utility claims likely to trigger Revenue enquiries

- Self-employed individuals with significant home office expenses

- International remote working arrangements

Audit preparation: If Revenue queries your claims, having professional support makes the process much smoother. We deal with these enquiries regularly and know exactly what Revenue wants to see.

Business advisory support: For e-commerce businesses, marketing agencies, and tech startups, remote working relief is just one piece of the tax optimisation puzzle. Comprehensive tax services can identify multiple savings opportunities.

Your Next Steps

Remote working relief in Ireland isn’t complicated once you understand the rules. The key is choosing the right relief type for your situation and maintaining proper records.

Here’s what I recommend you do right now:

- Calculate both options – work out the employer allowance and employee relief for your situation

- Check with your employer – ask if they offer the €3.20 daily allowance

- Gather your records – collect utility bills and create a home-working calendar

- Make your claim – use Revenue myAccount for current year relief

- Set up proper tracking – implement systems to track future home-working days

If you’re self-employed or dealing with complex scenarios, consider professional advice. The tax savings often far exceed the advisory costs.

Remember, this is your money. Revenue has created these reliefs to support remote working. You’ve earned the right to claim them.

Don’t be like that client who waited three years to claim €847. Start claiming what you’re entitled to today.

For personalised advice on remote working relief, contact us at Around Finance. We help e-commerce businesses, marketing agencies, and tech startups maximise their tax efficiency while staying fully compliant.

FAQs

Who qualifies for remote working relief in Ireland?

PAYE employees use remote working relief; self-employed individuals deduct home office expenses under business rules.

Can I claim both the €3.20/day employer allowance and remote work tax relief?

No, absolutely not. You cannot claim both reliefs for the same working days. Choose whichever option gives you the bigger benefit – usually the employer allowance for straightforward situations.

What expenses are eligible for remote working relief?

For employee relief: electricity, heating, and broadband costs at 30% of the working-from-home portion. For self-employed individuals: all reasonable home office expenses including utilities, insurance, repairs, and equipment.

Can I backdate my remote working tax claim?

Yes, you can claim relief up to four years retrospectively. If you’ve been working from home since 2020 and never claimed, you could be entitled to significant backdated relief.

Do I need proof from my employer to claim the relief?

It’s recommended but not always mandatory. Revenue may ask for employer confirmation during reviews, so having a letter or email confirming your working arrangements is wise.

Is there a cap on how much I can claim?

There’s no specific cap, but your claims must be reasonable and proportionate to your actual costs and working patterns. Excessive claims will trigger Revenue enquiries.

Does working from a co-working space count?

No, remote working relief specifically applies to working from your home residence. Co-working space costs might be claimable as business expenses for self-employed individuals, but not under home office relief.