Starting a tech startup in Ireland is an exciting journey filled with innovation, opportunity, and challenges. However, beyond a brilliant idea and technical expertise lies the critical need for tech startup funding. Whether you’re building an e-commerce platform, marketing agency, or SaaS business, understanding the funding landscape is essential to turning your vision into a thriving company.

Over the years, we’ve guided numerous startups through their funding journeys, witnessing firsthand how the right capital at the right time can transform a promising idea into a successful business.

This 2025 guide will help you manage the complexities of grants for tech startups, seed capital, business angel investment, venture capital, and more. We’ll cover government support, private funding options, and practical strategies to secure the capital your Irish tech startup needs.

The Irish Tech Startup Funding Ecosystem In 2025

Ireland’s tech sector remains vibrant and attractive to investors despite global economic uncertainties. In 2024 alone, Irish tech startups raised over €1.2 billion, with fintech, healthtech, and sustainability ventures leading the way.

Key players include government agencies like Enterprise Ireland and Local Enterprise Offices (LEOs), which provide vital early-stage funding and support. Alongside them, private investors such as business angels, venture capital firms, and corporate investors form a robust funding pipeline.

Ireland’s strong international ties, especially with the US and EU markets, provide startups with access to foreign investment and global expansion opportunities-a significant advantage for scaling tech businesses.

Sector-Specific Funding Opportunities

- E-commerce: Investors focus on logistics innovation, personalisation tech, and sustainable retail solutions. Emerging technologies such as AI and AR further enhance investment appeal.

- Marketing Agencies: Agencies with proprietary technologies or scalable service models attract private equity and strategic buyers.

- SaaS Businesses: SaaS remains a favorite for investors, especially solutions targeting healthcare, financial services, and productivity sectors.

Economic Factors Impacting Funding

- Post-Brexit Stability: Ireland’s position as an English-speaking EU member attracts businesses seeking European headquarters.

- Global Economic Pressures: Rising interest rates and inflation have made investors more selective, emphasising profitability and business fundamentals.

- Sustainability Focus: ESG considerations are increasingly influencing investment decisions, with dedicated funding for climate and sustainability startups.

Emerging Trends in Tech Startup Funding

Along with standard funding sources, the Irish tech startup funding landscape is being shaped by a number of new trends:

- Increased Focus on Deep Tech: Technologies such as AI, blockchain, quantum computing, and biotech are attracting specialised funding pools.

- Rise of Impact Investing: Investors increasingly seek startups that combine profit with positive social or environmental impact.

- Growth of Corporate Venture Capital: Large corporations are establishing venture arms to invest strategically in startups aligned with their business goals.

- Hybrid Funding Models: Startups are blending grants, equity, debt, and crowdfunding to optimise capital structure and reduce dilution.

Government Grants For Tech Startups In Ireland

Government grants provide non-dilutive capital-funding that does not require giving up equity, making them highly attractive for early-stage startups.

Local Enterprise Office (LEO) Grants

LEOs are often the first stop for startups seeking government support. Key programmes include:

- Feasibility Study Grants: Cover up to 50% of costs (max €15,000) for market research, prototyping, and business planning.

- Priming Grants: Up to €150,000 (or €175,000 in some regions) for startups under 18 months, covering capital expenses, marketing, consultancy, and select salaries.

- Business Expansion Grants: For businesses ready to scale beyond the startup phase.

Enterprise Ireland Supports

For startups with high growth potential:

- High Potential Start-Up (HPSU) Fund: Equity funding from €50,000 to €650,000 for startups with export potential and job creation prospects.

- Innovation Vouchers: €5,000 vouchers to collaborate with academic and research institutions.

- Pre-Seed Start Fund: €50,000 to €100,000 convertible loans for market-ready product development.

- Innovative HPSU Fund: Up to €1.2 million equity for groundbreaking innovations.

You can learn more about these opportunities in our detailed guide on ‘Things To Know When Applying For Enterprise Ireland Funding’.

Specialised Government Grants

- Disruptive Technologies Innovation Fund (DTIF): For collaborative projects with disruptive potential.

- AI & Machine Learning Grants: Up to 50% funding for AI projects via Digitisation Voucher and Agile Innovation Fund.

- Green Enterprise Fund: For eco-friendly startups focusing on sustainability.

- Research, Development & Innovation (RD&I) Supports: Includes a 25% tax credit for qualifying R&D activities.

EU Funding Opportunities

- Horizon Europe Programmes: Grants for research and innovation across tech sectors.

- European Innovation Council (EIC) Accelerator: Grants up to €2.5 million plus equity investments up to €15 million for high-impact startups.

How to Maximise Your Chances of Winning Grants

Winning government grants is competitive. Here are tips to improve your success rate:

- Detailed Project Plan: Clearly define objectives, milestones, and expected outcomes.

- Strong Market Validation: Demonstrate demand and commercial potential.

- Accurate Budgeting: Provide realistic and well-justified cost estimates.

- Alignment with Funding Priorities: Tailor applications to the specific goals of each grant programmes.

- Professional Presentation: Use clear, concise language and provide supporting documents.

For a full list of grants and supports, download our free guide: Every Business Grant And Support Available In Ireland.

Seed Capital And Business Angel Investment

While grants provide early-stage support, private investment often fuels growth and scaling.

Understanding Seed Capital

Seed capital funds product development, market validation, team building, and early marketing. Typical seed rounds in Ireland range from €50,000 to €500,000, usually in exchange for 10-25% equity.

The Business Angel Landscape in Ireland

Business angels are high-net-worth individuals investing personal capital and expertise. The Halo Business Angel Network (HBAN) is Ireland’s primary angel network, with sector-specific syndicates such as Bloom Equity (digital tech) and WxNW (western/northwestern regions).

Angels add value beyond money by offering mentorship, industry contacts, operational support, and connections to follow-on investors.

Tips for Approaching Business Angels

- Develop a compelling pitch deck highlighting your value proposition, market opportunity, and traction.

- Network at events like TechIreland, Dublin Tech Summit, and HBAN forums.

- Prepare for due diligence with organised financials and legal documents.

- Align expectations on valuation, exit strategy, and investor involvement.

Crowdfunding As An Alternative Seed Funding Source

Equity crowdfunding platforms like Spark Crowdfunding (Ireland’s first equity platform), Seedrs, and Crowdcube allow raising capital from many small investors.

Success requires a strong narrative, pre-campaign marketing, transparent updates, and attractive investor terms.

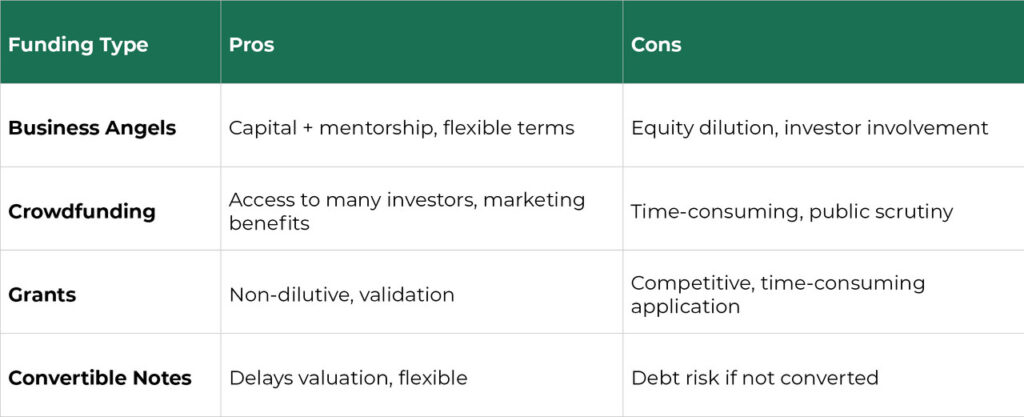

Pros and Cons of Seed Funding Options

Venture Capital And Private Equity

For startups with proven traction and growth potential, venture capital (VC) and private equity (PE) provide substantial funding to scale nationally and internationally.

The Irish VC Scene

Ireland hosts both domestic VCs (Frontline Ventures, Delta Partners, ACT Venture Capital) and attracts international firms (Sequoia Capital, Andreessen Horowitz, Index Ventures). Corporate venture arms like Google Ventures and Intel Capital also invest actively.

Preparing for VC Funding

- Build a scalable business model.

- Demonstrate strong market traction.

- Provide detailed financial projections.

- Assemble a skilled, experienced team.

The VC Funding Process

- Initial outreach and screening.

- Preliminary meetings.

- Due diligence.

- Term sheet negotiation.

- Legal documentation and closing.

The process typically takes 3-6 months.

Private Equity for Established Tech Companies

PE firms invest in mature companies via:

- Growth Equity: Capital for expansion without ownership change.

- Buyouts: Acquiring controlling stakes to improve operations or prepare for sale.

PE investments usually start at €5-10 million.

How to Position Your Startup for VC and PE Investment

- Focus on clear product-market fit with scalable revenue streams.

- Build a strong management team with complementary skills.

- Develop a compelling growth story supported by data.

- Maintain clean legal and financial records.

- Cultivate relationships with investors well before fundraising.

How Around Finance Supports Your Funding Journey

At Around Finance, we provide specialised accounting and advisory services tailored to tech startups, helping you prepare financially for funding rounds and manage growth effectively.

Financial Readiness

- Detailed financial forecasts using cloud tools like Xero.

- Management accounts for clear performance visibility.

- Cash flow management systems.

- Due diligence preparation.

Industry-Specific Expertise

- E-commerce accounting integrating sales channels and payment processors.

- Marketing agency finance management.

- SaaS metrics tracking (MRR, CAC, LTV).

Ongoing Growth Support

- Strategic financial planning.

- Investor reporting.

- Tax planning and R&D credit maximisation.

- Board and management reporting.

Building Your Funding Strategy For Success

Managing Ireland’s tech startup funding ecosystem requires a strategic approach tailored to your business stage and goals. Combining government grants, seed capital, angel investment, venture capital, and private equity in the right sequence maximises your chances of success.

Professional financial management is critical-not only to secure funding but to use it effectively for sustainable growth.

At Around Finance, we’re proud to support Irish tech entrepreneurs with expert financial guidance and funding strategy development. Contact us today for a consultation tailored to your startup’s unique needs.

FAQs

What types of funding are available for tech startups in Ireland?

Irish tech startups can access government grants, seed capital, angel investment, venture capital, private equity, and crowdfunding.

Are government grants available for early-stage tech startups?

Yes, Local Enterprise Offices and Enterprise Ireland offer various grants designed to support early-stage tech startups.

What is the difference between seed capital and venture capital?

Seed capital funds initial product development and market validation, while venture capital supports startups with proven traction aiming to scale rapidly.

How can I find business angel investors in Ireland?

The Halo Business Angel Network (HBAN) is the main platform connecting Irish startups with angel investors.

Do government grants require giving up equity?

No, government grants provide non-dilutive funding, meaning you don’t have to give up ownership in your startup.

What sectors are most attractive to investors in Ireland?

Fintech, healthtech, sustainability, e-commerce, marketing tech, and SaaS are among the most attractive sectors.

Can Irish startups access EU funding programmes?

Yes, programmes like Horizon Europe and the European Innovation Council Accelerator offer significant funding opportunities.

How important is financial preparation when seeking funding?

Very important-investors expect detailed forecasts, clean financial records, and clear business metrics.

What is crowdfunding, and is it suitable for tech startups?

Crowdfunding raises capital from many small investors and works well for consumer-facing or broadly appealing tech products.

How long does the venture capital funding process usually take?

The VC funding process typically takes between 3 to 6 months from initial contact to closing.