Irish businesses are sitting on a goldmine of untapped tax relief. Yet many don’t even know it exists.

The Research and Development (R&D) tax credit scheme in Ireland offers companies up to 30% back on qualifying innovation expenditure. This isn’t just theoretical money, it’s real cash that can transform your business’s financial position and fuel your next phase of growth.

For e-commerce brands developing new platforms, marketing agencies creating proprietary tools, or SaaS companies building cutting-edge software, R&D tax credits represent one of the most valuable financial incentives available. The scheme has become increasingly generous, with the credit rate jumping from 25% to 30% in 2024, making it more attractive than ever for Irish SMEs and tech startups.

This guide will walk you through everything you need to know about R&D tax credits in Ireland. You’ll discover what qualifies, how to claim, and most importantly, how to maximise your relief to reinvest in innovation and growth. Whether you’re a startup developing your first product or an established SME looking to expand, understanding R&D tax credits could be the financial boost your business needs.

Understanding R&D Tax Credits In Ireland

The R&D tax credit is Ireland’s way of encouraging companies to innovate and develop new technologies, products, and processes. It’s not just a small perk, it’s a substantial financial incentive that can significantly impact your bottom line.

What exactly is the R&D tax credit?

The R&D tax credit allows qualifying companies to claim a credit of 30% against their corporation tax liability for expenditure on eligible research and development activities. If your credit exceeds your corporation tax bill, you can carry it forward for use in future years or, in certain circumstances, receive a refund.

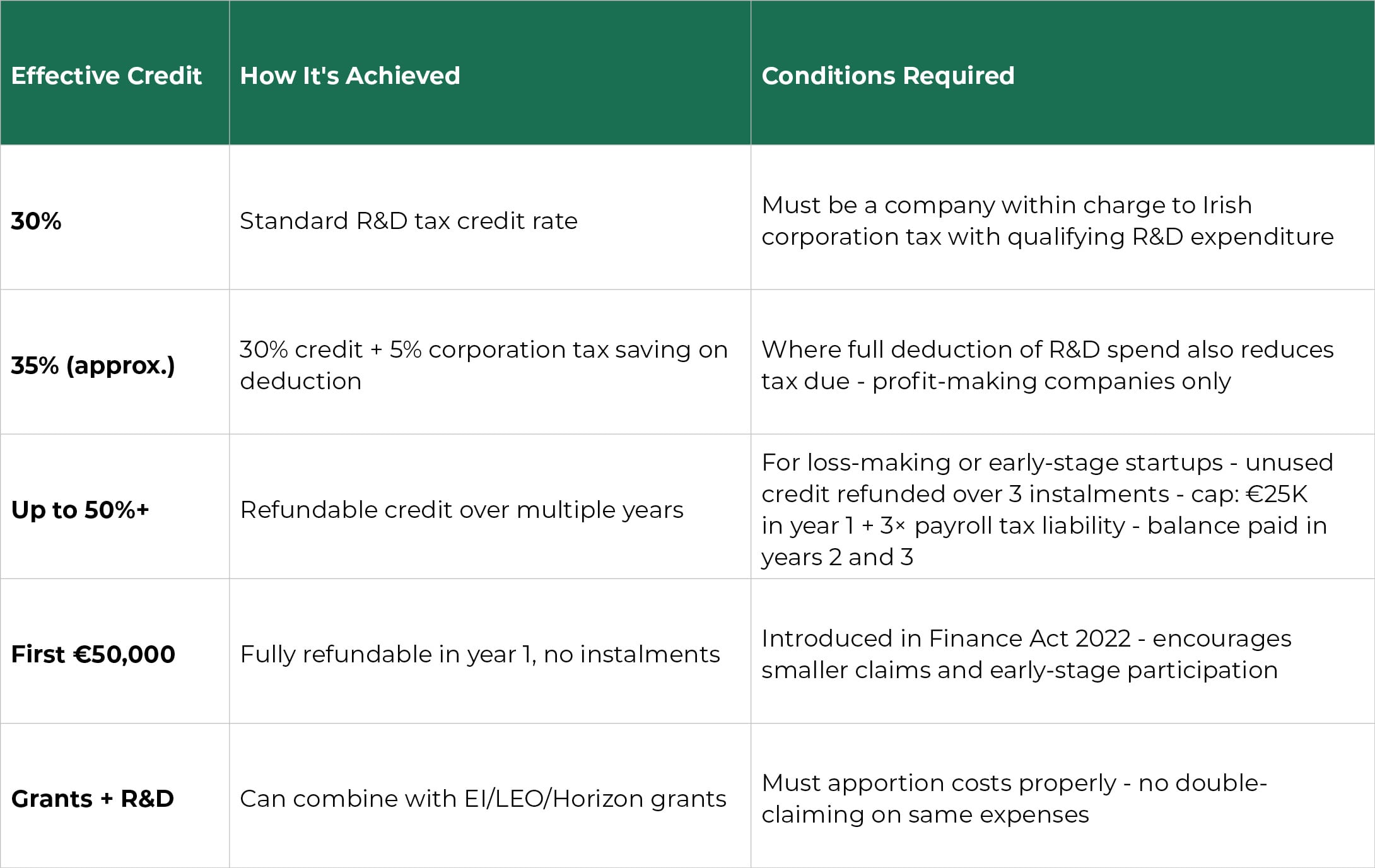

R&D Tax Credit Rates in Ireland (2024–2025)

Understanding the effective rates available can help you plan your R&D activities more strategically:

Key points to understand:

- 30% is the core rate of credit on qualifying R&D spend (increased from 25% pre-2024)

- If you’re profitable, you may get an effective benefit of approximately 35% due to both the R&D credit and corporation tax deduction on the same costs

- If you’re pre-profit, the credit is refundable, subject to limits and split over three years (except for the first €50K which is refunded up-front)

- Revenue operates a three-year instalment model for refunds, but the first €50K rule helps startups significantly

Key eligibility criteria include

- Your company must be incorporated and tax resident in Ireland or have a branch here

- You must be subject to Irish corporation tax

- The R&D activities must advance overall knowledge or capability in a field of science or technology

- The work must involve appreciable novelty and technical uncertainty

- The activities must be undertaken systematically by qualified persons

For SMEs and tech companies, this generally covers a wide range of activities you’re probably already doing. Software development projects, creating new algorithms, developing proprietary systems, and improving existing processes often qualify.

Qualifying activities for tech-focused businesses

The scope of qualifying R&D is broader than many business owners realise. For e-commerce brands, this might include developing new customer recommendation systems, creating innovative payment processing solutions, or building advanced analytics platforms. Marketing agencies often qualify when they’re developing proprietary tools for campaign management, creating new data analysis methodologies, or building custom reporting systems.

SaaS companies have numerous qualifying activities. From core product development to creating new integrations, improving security protocols, or developing AI-powered features. Even process improvements can qualify if they involve genuine technical innovation and uncertainty.

Qualifying expenditure categories

- Employee costs: Salaries and benefits for staff directly involved in R&D activities

- Materials and consumables: Software licences, cloud computing costs, and other materials used in R&D

- Plant and machinery: Equipment used exclusively for R&D purposes (subject to certain restrictions)

- Overheads: A portion of general business costs that support R&D activities

- Contracted R&D: Payments to third parties for R&D services

Recent legislative changes

The Irish government increased the R&D tax credit rate from 25% to 30% for expenditure incurred from 1 January 2024. This change makes the scheme even more attractive and demonstrates the government’s commitment to supporting innovation in Irish businesses.

Integration with other incentives

The R&D tax credit works alongside other supports available to Irish businesses. You can combine it with various grants and funding programmes, though you need to be careful about double-claiming for the same expenditure. The credit also interacts with other tax reliefs, and proper planning can help you maximise the overall benefit.

Financial Benefits Of R&D Tax Relief

The financial impact of R&D tax credits in Ireland extends far beyond simple tax savings. For growing businesses, these credits can be transformational.

Immediate financial benefits

The most obvious advantage is the direct reduction in your corporation tax liability. For a company spending €100,000 on qualifying R&D activities, the 30% credit provides €30,000 in tax relief. This isn’t a deduction, it’s a direct credit against your tax bill.

If your R&D credit exceeds your corporation tax liability, you can carry the excess forward indefinitely. SMEs may also be eligible for a payable credit in certain circumstances, providing immediate cash flow benefits.

Cash flow improvements

R&D credits can significantly improve your working capital position. Many businesses use the anticipated credit to secure better financing terms or reduce their reliance on external funding. The predictable nature of the relief makes financial planning more straightforward.

Sector-specific advantages

E-commerce brands benefit particularly from R&D credits when developing proprietary technology platforms, creating innovative customer experience tools, or building advanced logistics and fulfilment systems. These businesses often have substantial software development costs that qualify for relief.

Marketing agencies can claim credits for developing new analytical tools, creating proprietary campaign management systems, or building innovative reporting platforms. The digitisation of marketing has created numerous opportunities for qualifying R&D activities.

SaaS companies typically have the highest proportion of qualifying expenditure, as their core business activities often involve continuous product development, feature enhancement, and technical innovation.

Investment attraction and scaling

R&D credits make your business more attractive to investors. The tax efficiency demonstrates good financial management, while the qualifying activities show genuine innovation. Many investors view consistent R&D credit claims as a positive indicator of a company’s technical capabilities and growth potential.

Competitive positioning

Companies that effectively use R&D credits can reinvest the savings in further innovation, creating a virtuous cycle of development and tax relief. This gives them a significant advantage over competitors who aren’t maximising available incentives.

Overcoming R&D Credit Barriers

Despite the substantial benefits available, many eligible businesses don’t claim R&D tax credits. Understanding the common misconceptions and challenges can help you avoid these pitfalls.

“We’re not doing real R&D”

This is the biggest misconception we come across. Many business owners think R&D only applies to companies in white coats working in laboratories. In reality, if you’re solving technical problems, developing new software features, or improving processes through innovation, you’re likely doing qualifying R&D.

The key test isn’t whether you call it “research and development”. It’s whether your activities advance overall knowledge or capability in science or technology through systematic investigation.

“Our industry doesn’t qualify”

Revenue guidance makes it clear that R&D tax credits in Ireland apply across all sectors. We’ve successfully claimed credits for businesses in retail, professional services, manufacturing, and numerous other industries. The focus is on the activities, not the sector.

“We’re too small to benefit”

There’s no minimum size requirement for R&D tax credits. Some of our most successful claims have been for startups and small businesses. In fact, smaller companies often benefit more because the credits represent a larger proportion of their tax liability.

Documentation and record-keeping challenges

Many businesses struggle with the documentation requirements. You need to maintain detailed records of qualifying activities, expenditure, and the technical uncertainties you’ve addressed.

This includes:

- Project documentation and technical specifications

- Time records for staff involved in R&D activities

- Financial records linking expenditure to specific projects

- Evidence of technical challenges and how they were resolved

The 90-day notification requirement

One critical requirement that catches many businesses off-guard is the need to notify Revenue of your intention to make an R&D claim within 90 days of your accounting year-end. Miss this deadline, and you could lose your entitlement entirely.

This notification doesn’t need to include full details. It’s simply alerting Revenue that you intend to make a claim. However, it’s absolutely essential and non-negotiable.

Integration with accounting systems

Properly tracking R&D expenditure requires good financial systems. Many businesses struggle to separate qualifying costs from general business expenditure. This is where professional accounting software becomes essential.

At Around Finance, we help clients set up their systems to automatically categorise and track R&D expenditure, making the claim process much more straightforward.

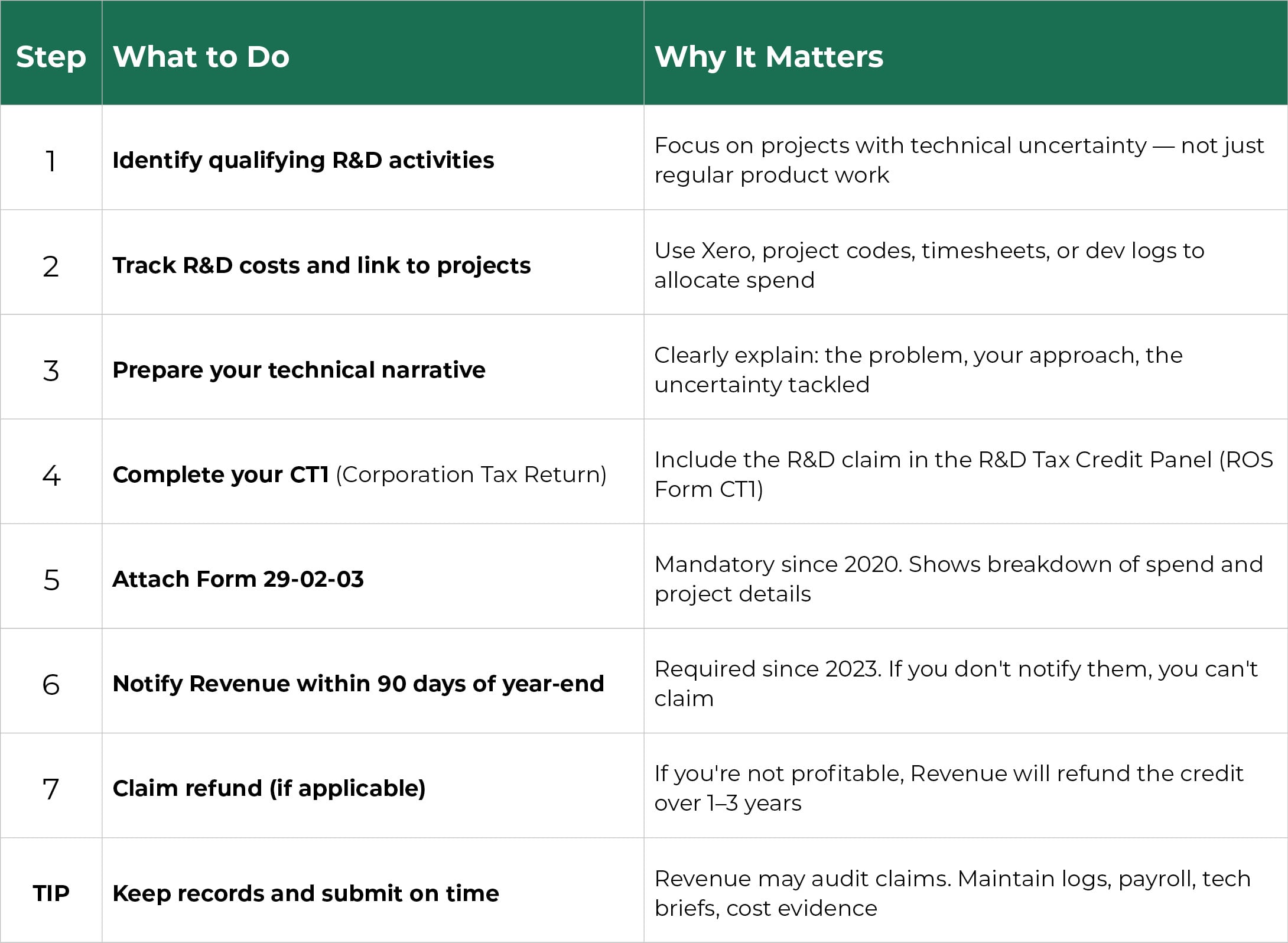

How to Claim the R&D Tax Credit (Step-by-Step for 2025)

Successfully claiming R&D tax credits in Ireland requires a systematic approach. Here’s the complete process for maximising your claim while meeting all compliance requirements.

Key reminders for your claim

- First €50,000 of a claim is refundable in full in Year 1 — no instalments

- If claiming for contracted R&D, include contractor details

- Revenue requires project-by-project breakdown — no vague bundling

- Start tracking from the beginning of the year, not at year-end

- Include all qualifying costs, including those that might seem minor

- Don’t forget about qualifying overheads – these can be substantial

- Consider whether any capital expenditure qualifies

- Review previous years to identify missed opportunities

Common pitfalls to avoid

- Claiming non-qualifying activities or expenditure

- Insufficient documentation to support the claim

- Missing the 90-day notification deadline

- Double-counting expenditure that’s already been grant-funded

- Inadequate technical descriptions in the narrative report

Combining R&D Credits With Additional Funding

R&D tax credits work best as part of a broader funding strategy. Ireland offers numerous grants and supports that complement the tax credit scheme.

Key grant programmes for tech businesses

Enterprise Ireland offers several schemes that work well alongside R&D credits:

- Innovation Partnerships: Funding for collaborative R&D projects

- R&D Fund: Direct funding for research and development activities

- Public Service Stability Undertaking (PSSU): Government-backed agreement supporting public sector workforce stability and collaboration, indirectly benefiting innovation and startups.

Local Enterprise Offices provide support for smaller businesses, including feasibility grants and business development funding.

EU programmes like Horizon Europe offer substantial funding for innovative projects, particularly those involving international collaboration.

Strategic combination of supports

The key to maximising available funding is understanding how different supports interact. You generally cannot claim R&D tax credits in Ireland on expenditure that’s already been grant-funded, but you can often structure projects to make the most of both.

For example, you might use grant funding to cover the initial research phase of a project, then claim R&D tax credits on the subsequent development and commercialisation activities.

Planning for maximum benefit

Effective funding strategies require forward planning:

- Map out your innovation pipeline for the next 2-3 years

- Identify which activities are best suited to grant funding versus tax credits

- Time your applications to align with your development schedule

- Maintain clear separation between grant-funded and tax credit activities

For a complete overview of available support, you can access our guide to ‘Every Business Grant And Support Available In Ireland’, which provides detailed information about dozens of programmes that might benefit your business.

Why Partner With Around Finance

Claiming R&D tax credits effectively requires expertise in both technical and financial areas. At Around Finance, we specialise in helping e-commerce brands, marketing agencies, and tech startups maximise their R&D relief while building robust financial systems for growth.

Our sector expertise:

We understand the unique challenges and opportunities in your industry. Our experience with tech startup businesses means we know what activities are likely to qualify and how to present them effectively to Revenue.

For e-commerce brands, we help identify qualifying activities in areas like platform development, customer experience innovation, and logistics optimisation. Marketing agencies benefit from our understanding of how digital tool development and process innovation qualify for relief.

Comprehensive service approach:

Our R&D tax credit service goes beyond simple compliance:

- Strategic planning: We help identify R&D opportunities and structure activities to maximise relief

- Systems integration: We set up your accounting systems to automatically track qualifying expenditure

- Documentation support: We help create and maintain the records needed to support your claims

- Ongoing compliance: We handle all interactions with Revenue and ensure deadlines are met

Technology integration:

We’re experts in integrating R&D tracking with your existing accounting systems. Whether you’re using Xero, QuickBooks, Sage, or Surf Accounts, we can set up automated processes to capture and categorise qualifying expenditure throughout the year.

Beyond compliance:

What sets Around Finance apart is our focus on using financial data to drive business growth. R&D tax credits are just one part of a comprehensive financial strategy that includes cash flow management, growth planning, and strategic decision support.

Ready to explore your R&D tax credit opportunities? Contact us for a consultation where we’ll review your business activities and identify potential areas for relief.

The time to act is now. Your future growth depends on the financial decisions you make today

FAQs

Do I need to be a large company to qualify for R&D tax credits?

No, there’s no minimum size requirement. SMEs and startups often benefit the most from R&D credits.

What happens if my R&D credit exceeds my corporation tax bill?

You can carry the excess credit forward indefinitely or, in certain circumstances, receive a refund.

Can I claim R&D credits on software development costs?

Yes, software development that involves technical innovation and uncertainty typically qualifies for R&D credits.

What’s the 90-day notification rule?

You must notify Revenue within 90 days of your year-end that you intend to make an R&D claim, or you’ll lose entitlement.

Can I combine R&D tax credits with grants?

Yes, but you cannot claim R&D credits on expenditure that’s already been grant-funded.

Do marketing agencies qualify for R&D tax credits?

Yes, when developing proprietary tools, creating new methodologies, or building innovative systems.

What if Revenue challenges my R&D claim?

Having proper documentation and professional support significantly reduces the risk of successful challenges.

Can I claim R&D credits on process improvements?

Yes, if the improvements involve genuine technical innovation and advance knowledge in your field.