Most agency owners focus on tracking revenue. But revenue isn’t the same as profit. More revenue can actually hide broken delivery models, underpriced services, or bloated overheads.

In this guide, we cut through the noise and show you what good profitability really looks like, with benchmarks, worked examples, and proven tactics used by top-performing agencies across Ireland, the UK, and the US. You’ll learn what drives margins and practical steps to improve your bottom line.

Understanding Key Profitability Metrics

Before implementing strategies, it’s vital to understand the core metrics that drive your agency’s financial performance.

Agency Gross Income (AGI)

AGI is your true revenue after subtracting pass-through costs such as media spend, contractor fees, or software licenses billed directly to clients. Think of AGI as the foundation for calculating profitability.

Example: You bill a client €10,000 for a marketing campaign, but €4,000 goes to paid media spend. Your AGI is €6,000, the amount available to cover costs and generate profit.

Delivery Margin

Delivery margin measures how efficiently your agency delivers services by subtracting direct delivery costs from AGI.

Formula:

Delivery Margin = AGI – Direct Delivery Costs

Direct delivery costs include staff time, freelancer and contractor fees directly tied to project delivery.

- Good margin: 50-70%

- Danger zone: Below 40% indicates efficiency problems

- Warning: If delivery margin stays above 65% without significant growth, you may be:

- Underpriced — increase your charge-out rate

- Overservicing — review your billable hours percentage

- Overpaying wages — review salary structures against roles and market benchmarks

Worked example:

An agency with €600,000 AGI and €360,000 in direct costs has a delivery margin of 40% (too low). By raising prices and cutting direct costs to €300,000, they improve delivery margin to 50%, a healthier level.

Utilisation Rate and Average Billable Rate (ABR)

- Utilisation rate: Percentage of time your team spends on billable work. Targets: 70-80% for non-client-facing staff, around 60% for client-facing team leads.

- Average Billable Rate (ABR): Average hourly charge rate.

Formula:

Revenue Capacity = Available Hours × Utilisation Rate × ABR

These metrics directly impact your revenue potential.

Overhead Costs

Overheads are costs not directly tied to client work, such as:

- Administrative staff salaries

- Office rent and utilities

- Software subscriptions (e.g., Xero)

- Marketing and sales expenses

Keeping overheads between 30-40% of AGI is generally healthy.

What Influences Your Agency’s Profit?

Understanding what pushes your margins up or drags them down helps you focus your efforts.

Delivery Costs

Staff time is usually your largest expense. Profitability depends on:

- Average cost per billable hour

- Accuracy of time tracking

- Project scoping and budget discipline

- Alignment of staff skills with roles

Even small improvements here can significantly boost your bottom line.

Client Retention and Acquisition

Acquiring new clients is more expensive than keeping existing ones. Research shows a 5% increase in client retention can boost profits by 25-95%.

Benefits of long-term clients:

- Lower onboarding costs amortised over time

- Increased team efficiency through client-specific knowledge

- Easier upselling and cross-selling opportunities

This applies across all marketing agency services, regardless of client size or specialisation.

Pricing Strategies

How you charge clients can make or break profitability. The right pricing approach can increase margins by 10-30% without extra work.

Different pricing models distribute risk differently:

- Hourly/day rates: Predictable but limit earning potential

- Fixed project fees: Reward efficiency but require accurate scoping

- Retainer agreements: Provide stable, predictable revenue

- Value-based pricing: Connect fees to client outcomes; highest profit potential but needs strong client communication and confidence in delivering measurable results

Value-based pricing works best when you can demonstrate clear ROI which is a great fit for ROI-driven marketing services.

Proven Tactics To Boost Your Agency’s Profit

Here are proven tactics to boost your agency’s financial performance across a few key areas.

Operational Efficiency Improvements

- Strong project scoping and budget tracking

- Clear change order processes

- Post-project reviews

- Automate time tracking, billing, and reporting

Consider using white-label software to streamline delivery while maintaining your brand identity.

Financial Planning and Budgeting

- Build 12-month financial forecasts and set quarterly goals

- Track actuals versus targets monthly

- Plan cash flow and tax obligations carefully

Cost Control

- Audit your software stack regularly

- Renegotiate contracts with vendors

- Cut low-ROI spending, including marketing and office expenses

Tax Planning

Work with financial advisors experienced in agency businesses to optimise your tax position. Consider:

- Claiming R&D tax credits for innovative client work

- Structuring your business for tax efficiency

- Timing major purchases to maximise reliefs

Staying up-to-date with Revenue requirements and opportunities is essential for Irish agencies to maximise after-tax profits and avoid compliance issues.

Client and Service Strategy Refinements

- Focus on client retention: Use satisfaction surveys, proactive communication, client success plans, and loyalty recognition

- Optimise service mix: Identify and promote high-margin services, phase out low-margin ones, package services to increase value, and develop proprietary methodologies

- Strategic pricing adjustments: Analyse profitability by client and project, implement annual rate increases, consider value-based pricing, and offer tiered pricing

Profitability Turnarounds

To illustrate the potential for significant financial improvements, let’s consider three scenarios based on common challenges faced by businesses. These examples demonstrate how different types of companies in Ireland might transform their financial performance through strategic changes.

Marketing Agency Success Story

A Dublin-based digital marketing agency client increased their delivery margin from 35% to 60% within six months by:

- Restructuring their team.

- Implementing integrated software.

- Adjusting their service mix.

E-commerce Brand Transformation

An Irish E-commerce brand improved its gross margin and customer lifetime value by:

- Adjusting their pricing strategy.

- Focusing on customer retention.

SaaS Startup Financial Restructuring

A Galway-based SaaS startup achieved positive cash flow by:

- Restructuring pricing.

- Implementing customer success programs.

- Focusing on features with revenue impact.

How Does Your Agency Compare?

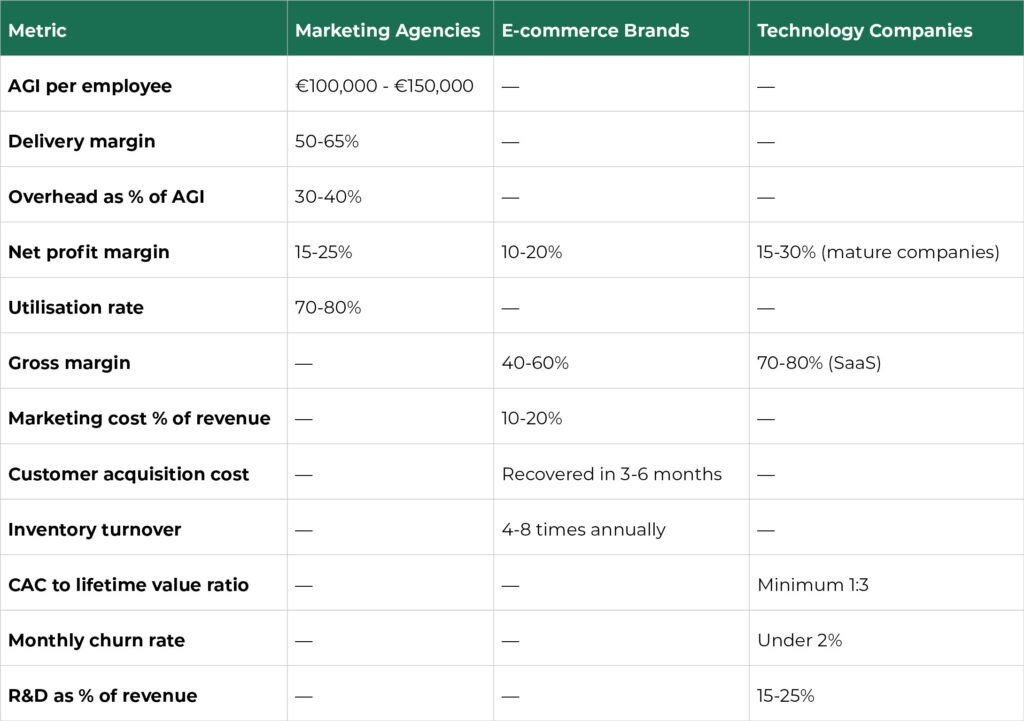

Use these targets to benchmark your agency’s performance:

For more detailed industry benchmarks and growth strategies, download our ‘Complete Marketing Agency Growth Guide’.

Easy Ways To Improve Your Agency’s Profit

Improving your agency’s profitability doesn’t have to be overwhelming. By following a clear, step-by-step process, you can identify opportunities, take focused action, and continuously refine your approach for lasting results:

- Assessment: Measure your current performance

- Prioritisation: Identify high-impact areas

- Planning: Develop specific strategies

- Implementation: Execute systematically

- Monitoring: Track progress against targets

- Adjustment: Refine strategies based on results

Integrate this process into your regular business planning cycle for best results.

How Around Finance Can Assist

At Around Finance, we help eCommerce brands, marketing agencies, and tech startups improve financial performance through:

- Financial health assessments

- Customised reporting dashboards

- Strategic planning and budgeting support

- Tax optimisation strategies

Improving agency profitability requires focus on multiple factors. By applying these strategies, Irish agencies can achieve sustainable profitability and growth.

For personalised advice, contact us for a consultation. Our team specialises in helping Irish businesses create more value with what they have.

FAQs

What is Agency Gross Income (AGI)?

AGI is your revenue after deducting pass-through costs, representing the income available to cover operational expenses and generate profit.

How can I improve client retention?

Implement client satisfaction surveys, proactive communication, and client success plans.

Should I use value-based pricing?

Value-based pricing offers high profit potential but requires excellent client communication and confidence in delivering measurable results.

What are common operational inefficiencies in agencies?

Poor project management, manual processes, and inadequate technology integration are common inefficiencies.

How can automation help my agency?

Automation streamlines tasks like time tracking, billing, and client onboarding, improving efficiency and reducing errors.

What is the key to sustainable profitability?

Focus on multiple factors—from operational efficiency to strategic client management—and create more value with the resources you have.